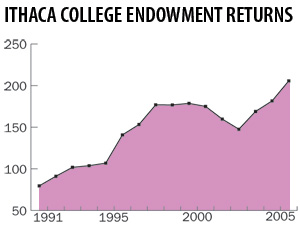

A new survey released by the National Association of College and University Business Officers (NACUBO) shows Ithaca College’s endowment performance significantly exceeds survey averages during one-, three- and five-year periods.

The 2006 NACUBO survey interviewed more than 765 colleges and universities across the country, according to an announcement from the college Jan. 24. Ithaca ranked 230 on the list, with an endowment size of $203.2 million.

The national average endowment returns for equally weighted institutions show 10.7 percent for one year, 11.9 percent for three years and 6.3 percent for five years. Ithaca’s endowment returns were 14.2 percent, 15.0 percent and 7.9 percent, respectively.

Carl Sgrecci, vice president of finance and administration, said the college’s return rate is high because of the diversity of its investments.

“We’ve been working for a number of years to develop a solid asset allocation strategy,” Sgrecci said. “We’ve determined what portions of our investment portfolio is in U.S. companies or international companies. There are a whole variety of variables, and we’ve tried to diversify to make sure we don’t have too much in one place.”

Aside from the one-, three- and five-year averages, the college also surpassed the average return rate for institutions with endowments of $100 to $500 million.

According to the survey, the cumulative average return rate of the survey’s comparable institutions in the 1997–2006 period was 76 percent annually. The college reached an 85 percent return rate in that same period.

Endowments differ from other gifts or grants in that the principle amount donated is never spent. In the case of the college, the endowment is invested in various companies where it appreciates and generates interest.

The accruement is what is measured as the return and is the only thing the college is allowed to spend. Sgrecci said not all the money generated by the endowment each year is spent, which he said may be the reason for the college’s high averages.

“We want to keep reinvesting part of the return every year to keep up with inflation,” he said. “That way 10 years from now, the endowment will have the same purchasing power as it does today.”

Most of the money from the college’s endowment returns go to financial aid, said Arthur Ostrander, dean of the School of Music.

“First and foremost, we are interested in scholarships,” he said. “We want to help defray the costs for students to attend school.”

Ostrander said donors can also specify how the money is to be used within a specific school or program.

“I’ve also had donors interested in establishing concert series for the community,” he said. “The interest from an endowment funds our ability to hire international artists to perform for the community and the School of Music itself.”

Specified donations in the School of Music include the Shirly and Charles Hockett Chamber Music Series, the Rachel Thaler Concert Piano Series and Louis K. Thaler Concert Violinist Series, Ostrander said.

Sgrecci said specified endowments are used in a variety of ways.

“The donor can give a gift to the college and say they want it given to a specific school, or to a specific professorship, so the donor has the discretion to specify how the gift is used,” he said. “Once it’s here, it goes into long-term investment pool.”

Susan Engelkemeyer, dean of the School of Business, said because high annual returns depend on smart investments, good consultants are vital in any endowment plan.

“It’s just like what you would do for personal investments,” she said. “You choose money managers who are well aware of your own risk profile and what you are trying to do — if you are trying to grow or stay even.”

Sgrecci said the college has a deliberate method of determining smart investments, and that in order to create an informed investment portfolio, the college brings in professional assistance.

“We use an external consultant to help us determine our investment policy and our asset allocation strategy, and it has worked well for us,” he said.