A recent New York state clothing tax exemption may soon have local consumers making bigger clothing purchases.

Clothing, footwear and items used to make or repair clothing sold for less than $110 are now exempt from New York state’s 4 percent sales tax because of the sales tax exemption reinstated as of Sunday. Despite the cut, Tompkins County will still maintain its own 4 percent sales tax on clothing.

The new exemption replaces the sales tax exemption that was only on items $55 or less, which was implemented in April 2011. The first 4 percent exemption on clothing and footwear under $110 occurred in 2000, but has often been suspended in order to balance the state’s budget.

Ted Potrikus, executive vice president of the Retail Council of New York State, said the difference in tax rates among states bordering New York created incentive for residents to shop elsewhere and caused legislators to consider a state tax break.

“The reason for its implementation initially was primarily for merchants down around New York City and the Southern Tier where you could bounce around the border and shop in PA or New Jersey, where they have lower or no sales taxes,” Potrikus said.

Merchants in New York City were losing business, he said, so the legislature tried a tax exemption for a week in the fall of 2000. What began as a two-week tax holiday has since turned into a yearly standard.

The tax reduction will not bring the entirety of New York to the same level as Pennsylvania and New Jersey, where there are little to no sales taxes on clothing and other goods. New

Jersey boasts having no sales tax on all clothing items, while Massachusetts and Pennsylvania set clothing as nontaxable with a few exceptions.

Each county in New York has the right to regulate local property and sales taxes, so only 11 counties will truly be at a zero percent tax rate on eligible clothing and footwear that individually cost less than $110.

“Anything over 4 percent is what’s charged by the local government,” Potrikus said. “The state will get rid of its sales tax on clothing and footwear, and if local governments want to go along with it, they can.”

Katie Spallone, owner of Evolution 102 in downtown Ithaca, said the exemption won’t really affect her store because the current tax has hardly made a difference.

“Most of our stuff is under $55 here anyway,” she said. “It’s not really something we’re going to notice. If people want to buy, I think they’ll buy.”

Kelly Moreland, owner of the local children’s store Mama Goose, said the change will bring revenue to her business as well as make for a more pleasant shopping experience because people know they are paying less.

“It’s really nice the way it’s happening at a change of season because that makes a difference for our business,” Moreland said.

Kevin Sutherland, budget coordinator of Tompkins County, said taxes affect consumers’ decisions about what to purchase.

“You look at the necessity of the choice to spend money on clothing,” he said. “People might be more inclined to buy something that’s between $55 and $110 now.”

Viewed as a price cut by state lawmakers, this tax exemption is estimated to increase state revenue by hundreds of millions of dollars according to Potrikus.

Sutherland said it is the people’s reception to the exemption that will prove whether consumers have more money to spend.

“Their confidence in how well things are going determines whether or not they go out and buy additional clothing items,” Sutherland said.

Potrikus said the tax exemption is a sign of the state’s improved economy.

“This is a signal that the state’s financial situation has righted itself in the last couple years and that the legislature feels comfortable enough with that to move forward with this exemption,” he said.

State and local governments alike are hoping that clothing and footwear stores get excited about the tax reduction and continue to bring in revenue. Ed Walsh, director of public information at the New York State Department of Taxation and Finances, said stores will advertise the tax break on their own.

“Retailers often do their own promotions and advertisements announcing the tax exemption, so it’ll definitely stimulate sales at the retail level,” Walsh said.

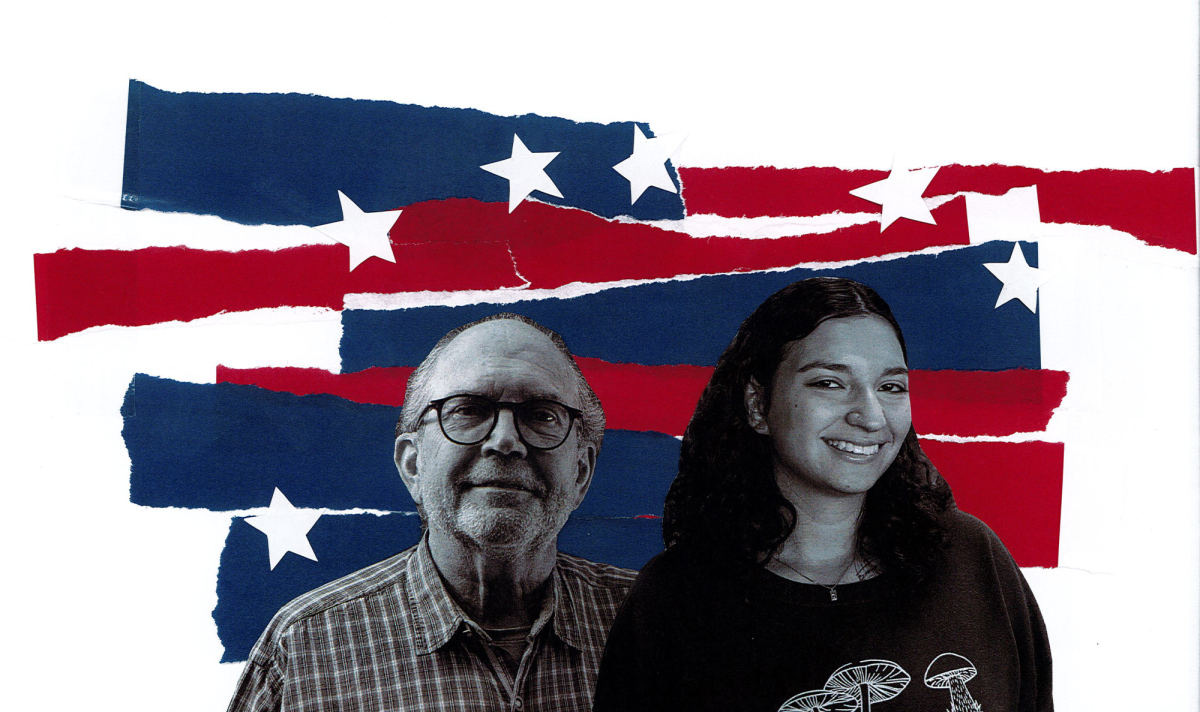

The exemption came as a pleasant surprise for freshman Angelique Hudson. She said she’s happy with any discount, even if it’s small.

“I’ll definitely shop more now,” Hudson said. “Little discounts make a difference, especially when you’re buying a lot of clothes.”

The state legislature has reflected its high hopes for the New York state economy by making the $110 and under tax exemption the indefinite state policy.

“But in Albany, whenever they say something is permanent, that means that it’s not,” Potrikus said.