ISO Student Health Insurance — a commonly used and affordable alternative health insurance provider for international students — has created a plan to meet Ithaca College’s requirements. This change comes after international students originally found out in February 2023 that ISO Student Health Insurance would not be accepted from Fall 2023 onward.

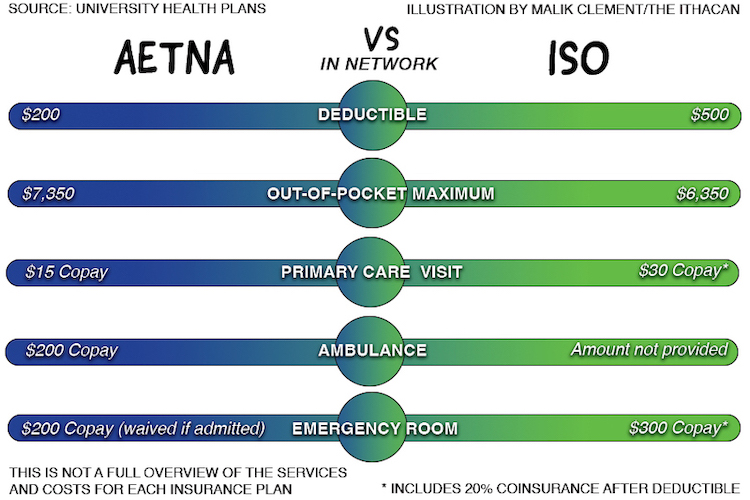

ISO Student Health Insurance created a plan specifically for the college so students would be able to continue using it as an alternative to the Student Health Insurance Plan. The new ISO Student Health Insurance plan — called ISO Care for Ithaca — costs $1,176 for a year and was revised to meet the college’s standards, but still provides less coverage than the SHIP. The college’s current SHIP is provided by Aetna Student Health and costs $3,066 for a year.

ISO Care for Ithaca exists in part because of student efforts. Upon learning about the SHIP change to Aetna over the summer, a group of international students who were concerned about the cost decided to look for a comparable plan that met the college’s minimum requirements at a lower cost.

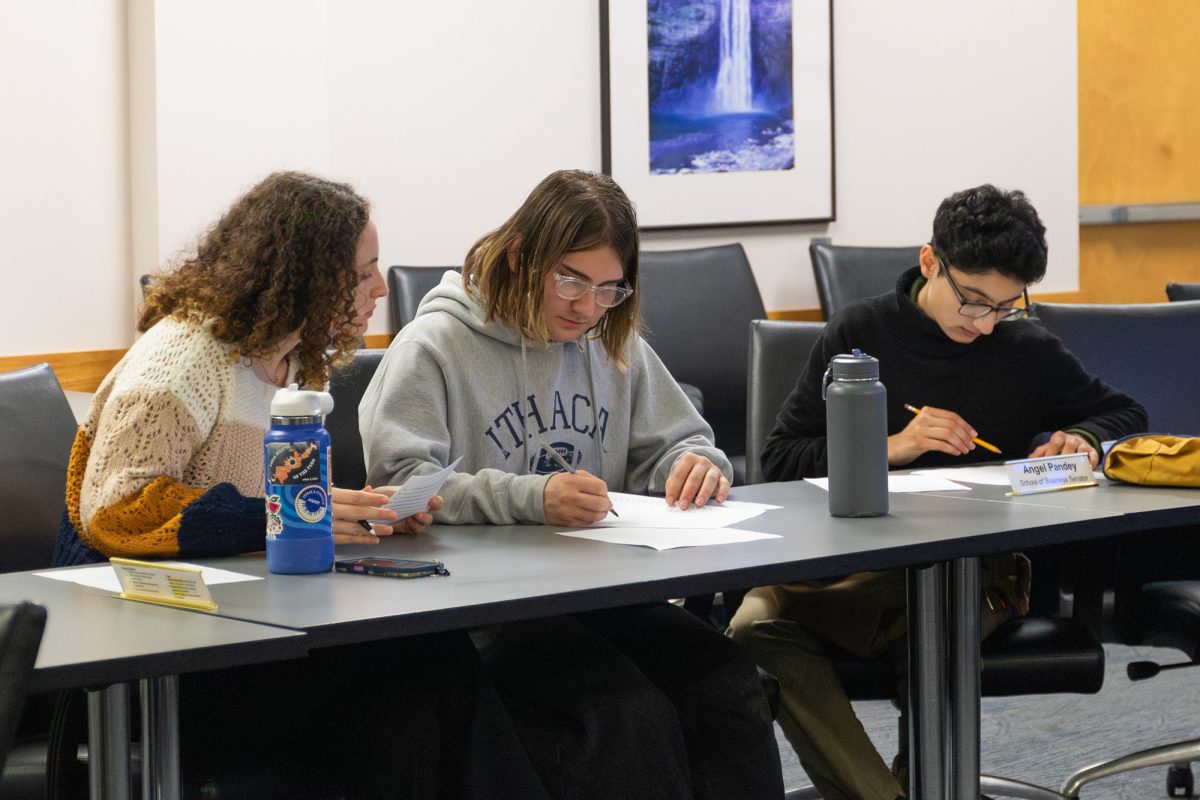

Junior Annabel Doamekpor, an international student from Ghana, was a part of this group and said that finding a different plan was essential for some students.

“People aren’t looking for health insurance that costs an arm and a leg,” Doamekpor said. “They are looking for health insurance they can afford but still matches the school’s policies.”

Doamekpor said she sent the college’s coverage requirements to ISO so that the provider could offer a plan that would be accepted as an alternative to the SHIP. Doamekpor said she chose ISO because she had friends who had used it.

Representatives from ISO Student Health Insurance and Kristen Devine, senior account manager at University Health Plans, worked together to create an ISO plan with enough coverage to meet the college’s standards. UHP is an intermediary brokerage company that assists the college by accepting or denying alternate plans to the college’s SHIP based on requirements set by the college.

“[Devine and ISO] started working together and I was like, ‘Okay, maybe this is going somewhere,’” Doamekpor said. “After they were done, [ISO] brought up a whole new plan based off that conversation.”

Tim Downs, chief financial officer and vice president for Finance and Administration, said that the focus is on what is best for students and that the college does not make a profit from enrollment in the SHIP.

“ISO actually made changes to the plan and I would say they only did it because we said, ‘If you don’t offer it, we won’t accept it,’” Downs said. “So, because of that, ISO provided more benefits to the people who had their plan.”

Related resources:

Why the ISO plan was initially rejected

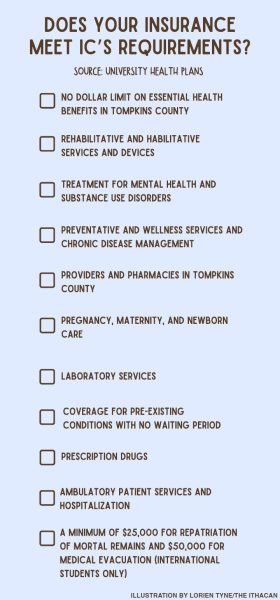

Downs said the ISO health insurance plans were not initially approved because they did not meet the standards set by the college. Specifically, Downs said the plans did not cover pre-existing conditions and substance abuse.

“You’re in college, there is probably going to be some substance abuse,” Downs said. “So, in many ways, I’d look and say we made the coverage for the students that have ISO better because we said, ‘You need to do this.’”

Downs said ISO Care for Ithaca is still not perfect because it requires a student to pay for the total cost of the service upfront and submit the bill to ISO for reimbursement. Downs said this could discourage students from seeking help when they need to.

“[Paying] that cash up front could be a huge deterrent for our students going to get health care,” Downs said. “If we’re finding students are not going and getting healthcare because they can’t afford that upfront payment and seek reimbursement, we may put a requirement in that [ISO] can’t have a reimbursement plan.”

For the 2023–24 academic year, Ithaca College changed its SHIP to Aetna Student Health, which costs $353 more than the previously used SHIP. However, Aetna is more cost-effective because it has better coverage. Unlike ISO Care for Ithaca, Aetna is a direct pay plan so students only pay their copay upfront and any additional coinsurance will be billed later.

Bonnie Prunty, vice president for Student Affairs and Campus Life, said ISO Care for Ithaca has an out-of-pocket maximum, which is a positive change. The ISO plan in previous years did not have an out-of-pocket maximum, meaning that there was no limit to the amount students would have to pay out-of-pocket if they used services and could potentially fall into debt.

“I will be anxious to see how the ISO plan works for our students this year,” Prunty said. “And we’ll evaluate it at the end of the year to make an appropriate decision about [whether or not] it provided the kind of coverage that our students really needed to be able to get the medical care they need while they’re here.”

Downs said that while the process of selecting a SHIP is conducted annually and is subject to change, he hopes the college can continue maintaining its relationship with ISO.

“It could be that next year ISO does not meet our requirements,” Downs said. “Now we would hate for it to ping pong. It would be great if they continue to do that. But what we’re going to do is, we’re going to look at the data.”

Background and process of selecting the SHIP

For the 2022–23 academic year, MVP Health Care provided the SHIP, which cost $2,713 for a year of coverage. When reviewing the SHIP, the college decided to look for a new insurance provider since MVP raised its price but maintained similar benefits as Aetna. UHP found the college a more cost-effective plan: Aetna Student Health. Devine said overall, Aetna provided the best premium, benefits and services.

Aetna costs $3,066 for a year of coverage and has better benefits like lower coinsurance — 30% instead of 40% — which includes out-of-network mental health visits and diagnostic tests, according to Devine.

Prunty said that reviewing and selecting the SHIP involves a bidding process. There are a limited number of companies in the marketplace that provide health insurance plans for students. She said UHP sends out a Request For Proposal — commonly called RFP — to the marketplace and interested parties get back to the college with proposals outlining details about their respective insurance plans.

Downs said UHP then works with these interested parties to decide which plan best meets the college’s standards.

“What UHP does is they then try to make it apples to apples,” Downs said. “Each one is a little slightly different. But some of those differences can be really expensive, like covering pre-existing conditions.”

Devine said via email that MVP Health Care, Excellus BlueCross BlueShield, Wellfleet Student, and UnitedHealthcare Student Resources were the other insurance providers that were considered before the college ultimately chose Aetna.

Enrollment form

UHP provided a new and optional enrollment form, in addition to a waiver form, which must be completed by Sept. 15. The sooner students enroll in the college’s SHIP, the sooner they will gain access to their health insurance benefits and card.

Devine said via email that the purpose of adding an enrollment form was to help students make an informed decision.

“The new enrollment/waiver process encourages the students to access the Ithaca College Student Health Insurance Plan … to learn more about the plan prior to completing an enrollment or waiver form,” Devine said.

Downs said via email that while students are automatically charged for the SHIP, most of the time they have not paid their full bill and the charge is not reflected on their accounts. However, if a student does pay their full bill — which includes the cost of the SHIP — and wants to waive it, the balance will be transferred as credit for next semester, or they can request to be reimbursed for it.

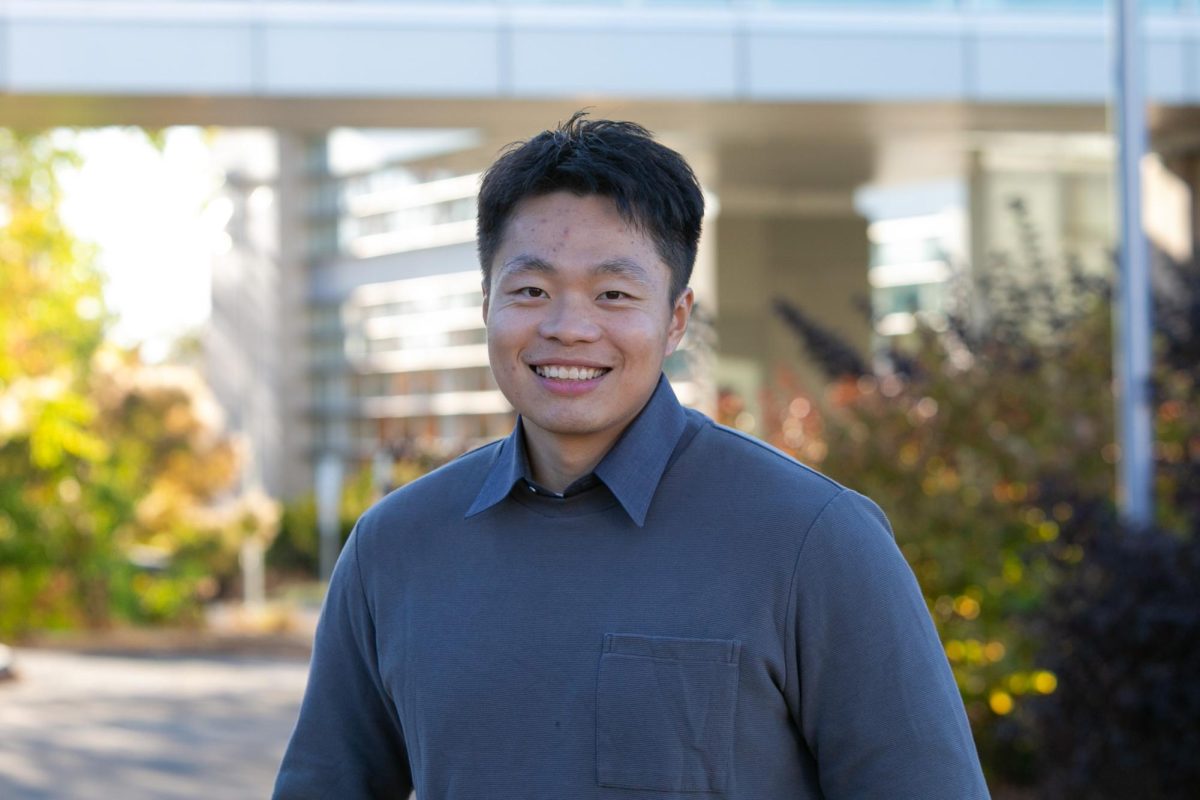

Senior Utkarsh Maini said that while he did appreciate the clarity in communication about the 2023–24 SHIP change, he still feels that international students do not have many options when it comes to health insurance.

“My initial thought was it is not even worth finding health insurance comparables and other stuff,” Maini said. “[The enrollment form] gives a little bit more flexibility and more time to decide if the person wants to go to another insurance plan or something like that.”

Prunty said she advises students to familiarize themselves with health insurance terms and procedures since it is a vital life skill. Prunty also encouraged students to think of insurance in a more holistic manner.

“I know insurance feels really complicated, but it’s something that you’re going to have to deal with … so it’s a good life skill to begin to kind of figure out how insurance works,” Prunty said. “It’s really easy to make insurance decisions based on how much your deductible is going to be … but it is short-sighted sometimes … because sometimes the lowest deductible does not have other great insurance with it.”