Understanding base compensation

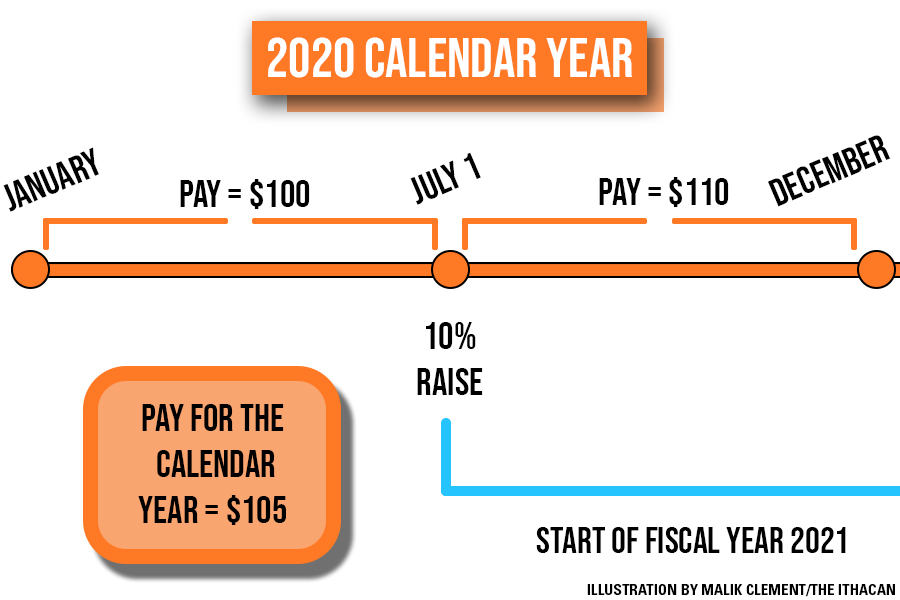

An employee’s base compensation refers to an employee’s compensation before including bonuses, employers’ contributions to retirement funds, benefits, expenses that the college spends on that employee or any additional form of pay. The list of employees’ base compensation in Schedule J Part II of the Form 990 is called a payroll. The payroll reflects a calendar year: Jan. 1 to Dec. 31. The rest of the Form 990, except for the payroll, is reflective of a fiscal year: July 1 to June 30.

For example, the 2021 Form 990 — which is data from the 2022 fiscal year — covers the dates July 1, 2021, to June 30, 2022. However, Schedule J and any information about employees’ pay is for a calendar year. Because half of the 2022 calendar year has not been reflected on the form, the college calculates back in time before the beginning of the fiscal year.

Tim Downs, chief financial officer and vice president of finance and administration at the college, said the payroll on the 2021 Form 990 is calculated based on the 2021 calendar year: Jan. 1, 2021, to Dec. 31, 2021. Raises are given to employees at the end or beginning of the fiscal year, which is halfway through the calendar year. Meaning, if an employee receives a raise, this will only be reflected in half of their calendar year base compensation.

Example (disclaimer: these amounts and dates are arbitrary, solely for the use of explaining how pay is calculated)

If an employee starts the 2021 calendar year making $100 per year, but receives a 3% raise starting July 1, 2021 and begins making $103 per calendar year, then the college calculates the full calendar year as follows:

- Six months (first half of the 2021 calendar year) at $100 per year ($100/2 = $50 for six months)

- Six months (second half of the 2021 calendar year) at $103 per year ($103/2 = $51.50)

- Six months + six months = $50 + $51.50 = $101.50 for the 2021 calendar year

All other compensation listed in Schedule J Part II is not part of base compensation.

Sean Kanazawich, controller in the Division of Finance and Administration, said that if an employee starts a position at any point during the fiscal year, that is reflected on the form. If an employee starts after the calendar year 2021 but during the fiscal year — meaning they started the position between Jan. 1, 2022, and July 1, 2022 — then the employee will not be reflected on the form. The employee will be on the next Form 990 when the calendar year 2022 will be recorded for salaries.

Kanazawich said that if an employee leaves during the fiscal year but is present at the institution during the full or partial calendar year, then the date they leave the college will be reflected on the Form 990. The pay information still only applies from Jan. 31 to Dec. 31 of the previous calendar year.

Kanazawich said the employees that are included on the Form 990 are all of the college’s officers, including the president, vice presidents and key employees. He said key employees are positions that act similar to officers and have similar responsibilities but do not technically have officer titles. For example, executive directors and deans would be considered key employees. Then, the college lists the next five highest-paid employees. Schools known for their athletics usually include coaches or athletic directors. At Ithaca College, the form lists professors and chairs of departments who are the next highest-paid employees.