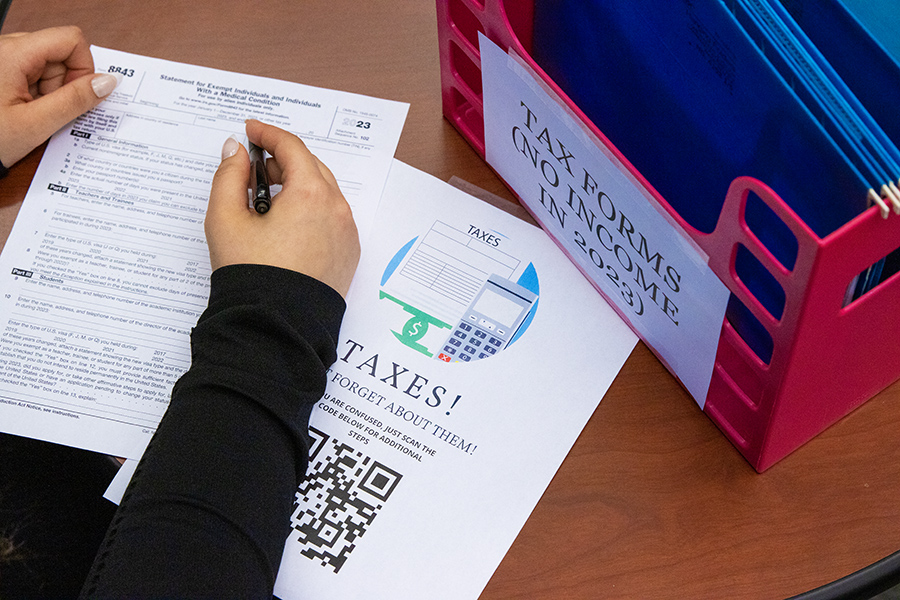

The Volunteer Income Tax Assistance (VITA) program is a service offered by the IRS that provides help in filing taxes to underprivileged communities. VITA at Ithaca College also provides free support to international students who may not be familiar with the tax filing process in the U.S.

VITA was founded in 1971 and since then has resulted in the development of more than 8,000 clinics across the country. VITA at the college is also running its second year of partnership with Ithaca Welcomes Refugees (IWR), a local nonprofit, to assist refugees in the area.

Kari Smoker, associate professor in the Department of Accounting and Business Law, is the site manager for the VITA at the college, which has been providing free tax service at the college for more than 25 years. Smoker said that this year, VITA at the college has around 200 clients. To initiate the process of assisting international students at the college, Smoker said she sends out an email to the international students who respond by filling out a consent form and then students can either set up a Zoom meeting or an in-person follow-up appointment with Smoker herself.

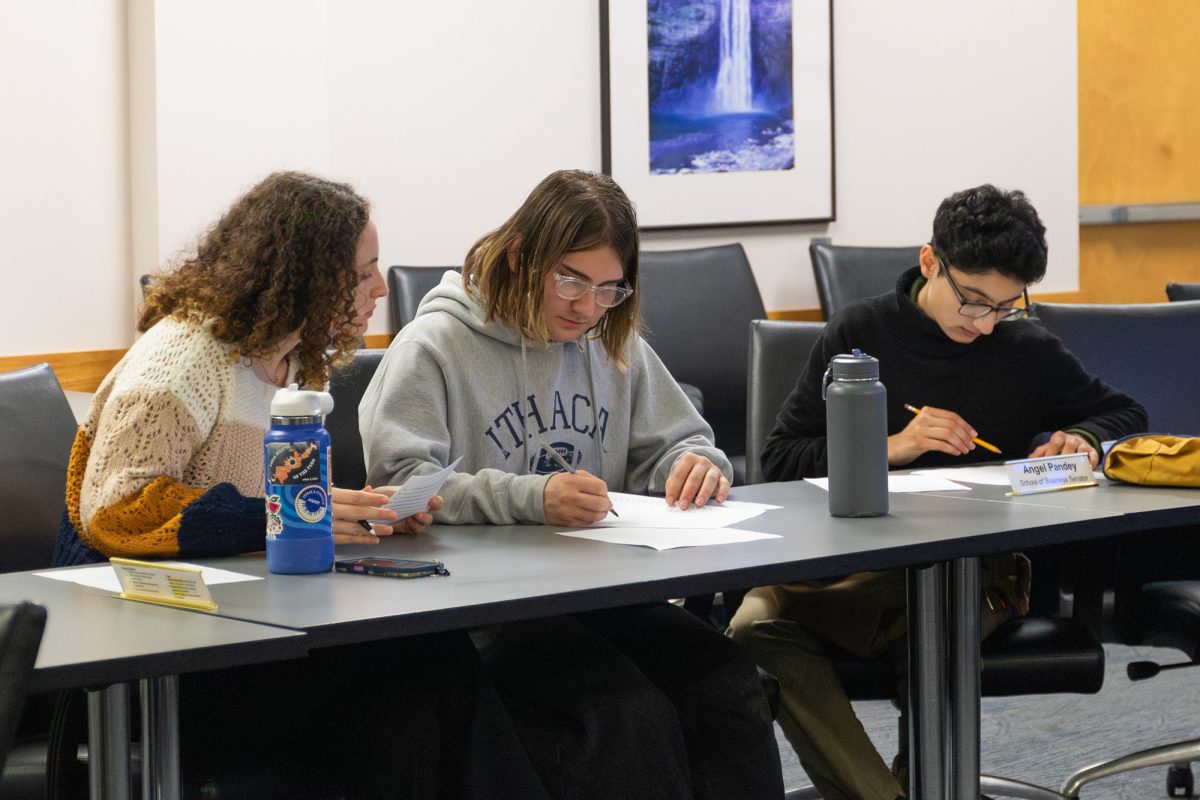

Along with Smoker, Sarah Germonprez, lecturer in the Department of Accounting and Business Law, and 13 student interns help with the operations of the college’s VITA Clinic. Student interns are involved with the entire tax filing process from start to finish with client intakes, the tax preparation process and reviewing returns with the clients.

“Our accounting majors are required to earn three credits in an accounting or tax internship to complete their degree program,” Smoker said. “The tax clinic is a 3-credit practicum they can enroll in to fulfill that requirement. The environment the student interns work in with the clients is also an ideal space for practical learning.”

Germonprez said that even though working with IWR can be counted toward internship credit, some students simply choose to volunteer to give back to the community.

“Because it’s a clinic, it’s not a lecture environment, we’re not in a classroom … so it’s very hands-on,” Germonprez said. “However, some students choose to volunteer just because they love the experience and being able to help other students file their taxes.”

Smoker said the partnership between IWR and VITA at the college is a fulfilling one and aims to ease the tax filing process as much as possible for both IWR clients and international students at the college.

“Our work with both Ithaca Welcomes Refugees and the international student population has been particularly meaningful,” Smoker said. “They want to do everything correctly and not jeopardize their ability to stay in the U.S. or return again in the future. To [be able to] ease their uncertainty and help walk them through the process is truly rewarding.”

Senior Birsen Gürkaynak, an international student from Cyprus, said she was easily able to navigate the entire process with the VITA with the college’s help.

“Having someone help us, in a country where we have no idea how the system works, was literally a blessing,” Gürkaynak said. “I’m from Cyprus, and I didn’t know that if I earned less than $2,000 for the year … I get the tax reduction. If it wasn’t for Kari, I wouldn’t know that. She told me that I was so happy, I ended up paying like a little amount of taxes.”

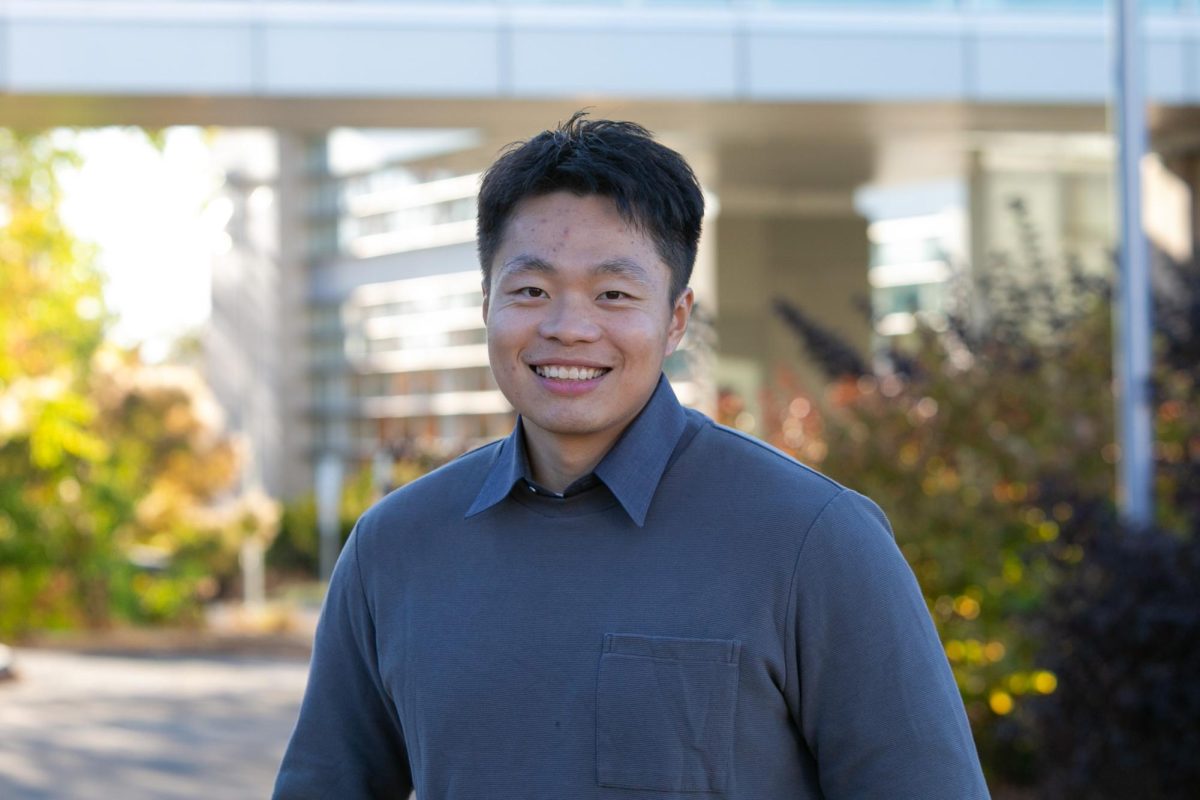

The tax season officially commenced in January with the release of W-2 forms and will end April 15. Junior Sameed Mubasher said he remembers how confused he was about the process three years ago.

“I still remember receiving my W-2 in my mail and I was like… ‘What does that mean and what do I have to do with it?’” Mubasher said.

Mubasher used the clinic and said he appreciates the fact that the service is being offered to international students for free.

“There’s no fees associated with it,” Mubasher said. “You just show up to the clinic and the rest is taken care of from there. All you need to do is get your documents together and just present it to [Smoker] and then she’ll be able to guide you on what’s needed.”

Gürkaynak said getting help with taxes goes a long way for her.

“It’s definitely one less thing on my plate as an international student,” Gürkaynak said. “Because I already have lots of problems with keeping up with the visa status and all that, in a foreign country. … Getting help really helps and makes me feel comforted to say the least.”

IWR, founded in December of 2015, is a volunteer-led and non-profit community initiative that aims to help newly arrived refugees and immigrants build their lives in Tompkins County and adjust to living in the U.S.

Casey Verderosa, the executive director of IWR, said via email that her goals for IWR are very specific to the clients she personally works with: to ensure each individual is settling into the U.S. smoothly and conveniently.

“We very much follow the lead of the families and individuals we work alongside and help them work toward their unique resettlement goals,” Verderosa said.

Verderosa said via email that for refugees, filing taxes in a country where they are still settling can be a daunting process.

“It can be overwhelming to navigate the U.S. tax system while dealing with all the other stresses of resettlement — learning a new culture and language, having access to few resources, worrying about family back home,” Verderosa said. “So we feel that any way that IWR and the rest of the community can alleviate burdens and provide clarity is a boost that we are invested in providing.”