The U.S. Department of Education (ED) announced Jan. 30 that data from the Free Application for Federal Student Aid (FAFSA) would begin to be sent to institutions around the country by mid-March, a significant delay from the originally-established timeline of late January.

This change to the FAFSA timeline will likely mean prospective students and their families will have less time to decide on a college or university while also considering the financial aid packages offered to them; however, Ithaca College will not be extending its Decision Day deadline.

The FAFSA form was recently given a make-over in 2023 to make the application process easier for students and families in need of federal aid, which involved pushing the date the application opens from Oct. 1 to Dec. 30.

A letter from Miguel Cardona, U.S. Secretary of Education, was sent to presidents and chancellors of higher education institutions Feb. 12 with an update on the delays and the steps the ED is taking to support them.

“If overhauling a system that hasn’t been touched in more than 40 years were easy, it would have been done before,” Cardona wrote.

However, the new FAFSA form has had glitches and technical errors along with the delays. These problems have made some college and university leaders reconsider Decision Day’s deadline of May 1, according to the U.S. News and World Report. With the delays, students will have a shorter window to consider the financial aid packages offered to them before the May 1 National College Decision Day.

The college has made an effort to guide families through this time of uncertainty while the typical deadline for FAFSA filing, which is June 30, swiftly approaches.

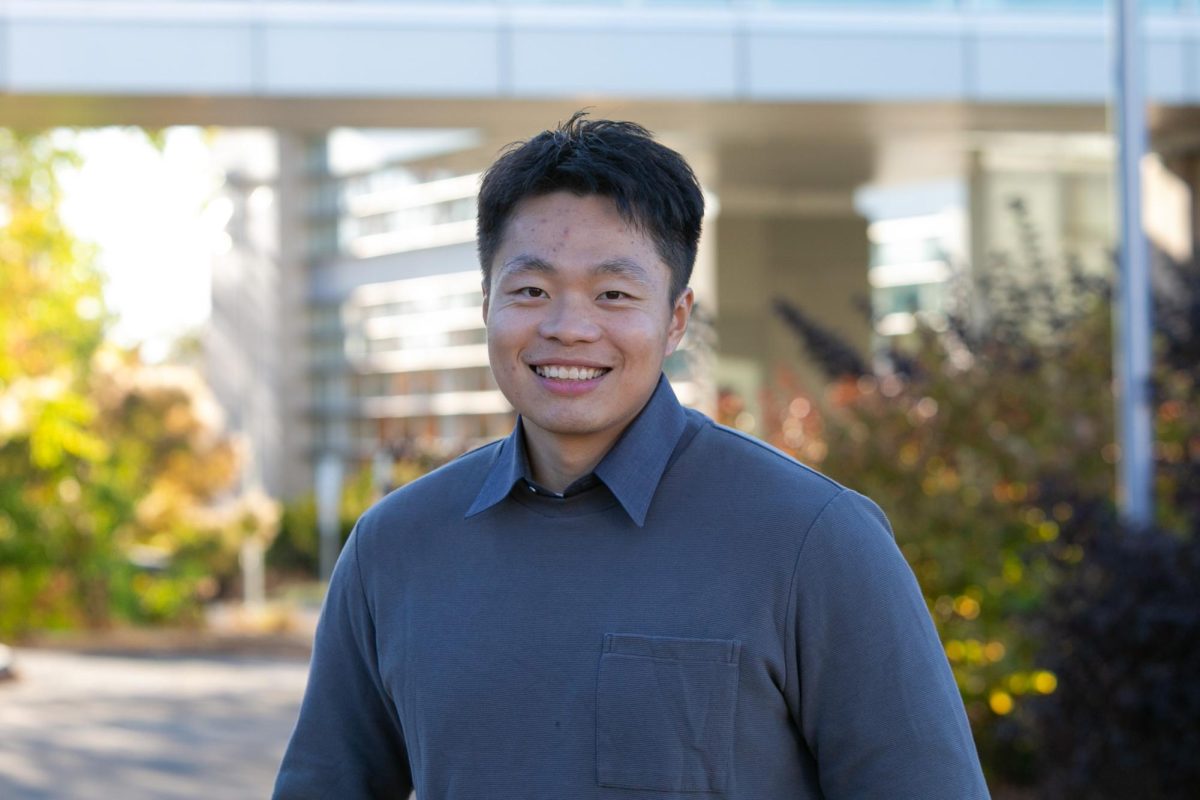

Shana Gore, associate vice president for Enrollment and Student Success at the college, said that the delay makes the college decision process more difficult for prospective students and their families.

“For prospective students, there are a lot of components that go into their college search process, and the financial piece is one of those,” Gore said. “The importance of that financial piece has a different priority for different families.”

In past years, when the FAFSA opened Oct. 1, the financial data used in aid packages the college prepared for accepted students would be available to institutions no later than November.

“That gave us a long window before students were even being admitted to the college, to start [standardized] testing, to have everything in place to be able to provide [financial aid] information to students very timely,” Gore said.

The ED has added to its FAFSA College Support Strategy, which assists colleges by providing federal personnel to help colleges prepare for and process financial aid forms. The ED also directs funding for technical assistance to under-resourced colleges.

A concierge service within Federal Student Aid has been launched at the ED to give institutions direct access to financial aid experts for additional support during the 2024-25 FAFSA process.

“We are implementing these changes so you and your colleagues can focus your attention and resources on getting aid award offers to students,” Cardona wrote.

Gore said she was concerned that students may not make the right decision if they do not have all of the financial aid information from each of the colleges they are considering.

“Obviously, we want every student to pick Ithaca, but what we really want is the students who know this is the right school for them, to pick it,” Gore said. “I don’t want someone to pick Ithaca if it’s not the right place for them, and they just didn’t have the information from the other schools that they needed.”

Gore said the college does not want to slow students down or cause barriers for them, so the college built its own SAI calculator. The Student Aid Index (SAI) is a form built in the college’s system where students provide the same financial data as the FAFSA form to determine their eligibility for federal, state and institutional programs and provide them an estimated financial aid package. Not all institutions use calculators like the SAI, so families who fill out the SAI form only get an estimate of their award package at the college.

“We were using [the SAI calculator] in December for early decision and early action students and … because it’s not just the delay, it’s that this form we are going to start receiving looks totally different from everything we received for the last 40 years,” Gore said.

Sara Sasenwein is a parent of a prospective student and recently attended an open house event at the college with her son, a high school senior. She said her son will be the first of her children to go to college. Sasenwein said the uncertainty in the FAFSA timeline is frustrating.

“The [ED] is saying mid-March right now, but who knows,” Sasenwein said. “We’ve gotten emails from schools saying that they’re going to delay Decision Day to May 15, but some schools not all, so it still puts the pressure on making a decision in two weeks because not all schools are doing it. It’s just a mess.”

All State Universities of New York (SUNY) will be extending their Decision Day deadlines. Other colleges, like Oregon State University and the University of Minnesota Twin Cities, will be extending their Decision Day deadlines as well, according to the New York Times.

Amy Munson, a senior financial aid counselor at Kennesaw State University (KSU), said the university is waiting for FAFSA forms to come in.

“[The delay] is causing us a lot of stress in our office, but at the same time we are just sitting here waiting,” Munson said. “There’s nothing we can do until we get those FAFSAs into our system.”

Cornell University encourages its continuing U.S. students to fill out the FAFSA each year to secure aid supplied when they were initially accepted and to make sure the aid comes on time. Munson said the changes and delays to the FAFSA will most likely not impact current students, but it is important to fill out each year.

“For continuing students, I do feel like it’s a little bit less stressful,” Munson said. “They can sort of assume that their aid package is going to look very similar to the previous year. Unless they’ve had a dramatic change in their family income.”