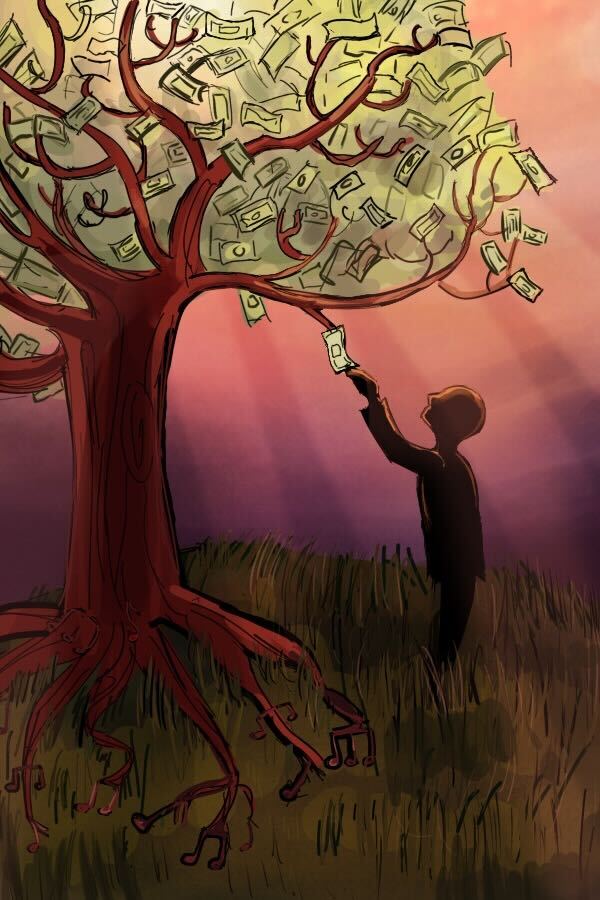

Ithaca’s high cost of living is driven by an expensive housing market and unusually high local tax burdens that have disproportionally fallen on homeowners and renters. Major landowners like Cornell University do not pay full property taxes, leaving the extra costs to Ithaca residents.

To protect the people of Ithaca, including faculty and staff at Cornell and Ithaca College, the City and Town of Ithaca must expand affordable housing and reform local tax relief to ensure local homeowners and renters pay fair prices. These exorbitant costs may drive away potential Ithaca residents, including those who would work at both Ithaca College and Cornell. It is not comfortable to live in Ithaca, even on the salary of a high-ranking professor.

Fair Market Rent trends for Tompkins County as a whole show how quickly rent has risen relative to national averages. Approximately 74% of Ithaca’s population are renters, with more than 50% of households spending over 30% of their income on rent.

In Tompkins County, the FMR for a two-bedroom apartment is higher than the New York state average. The increase in rent, about 12.3% since the beginning of 2022, compares poorly with wage growth, greatly contributing to the town’s affordability issues.

New housing developments in Ithaca do exist, but many of these rental units are geared towards students with short-term leases, limiting the options for non-students and working professionals.

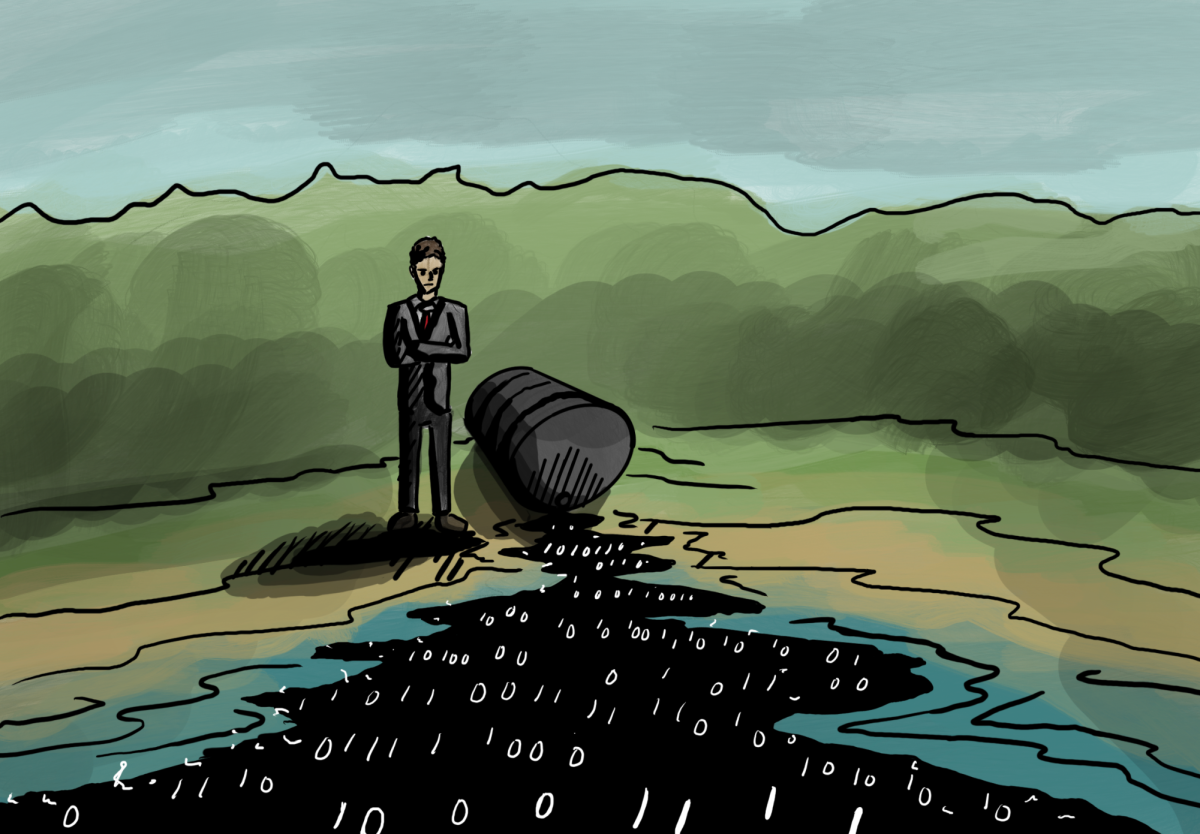

In the City of Ithaca, 37.89% of assessed property value is exempt from property taxes because both colleges in Ithaca are private, non-profit institutions. Cornell owns billions of dollars worth of tax-exempt property in Ithaca. In 2024 the Town of Ithaca created an agreement with Cornell for a $425,000 annual payment — a small settlement compared to the university’s large footprint.

Due to Cornell and IC’s tax-exempt status, the other property owners in Ithaca have to “make up” this lost revenue.

When big institutions like Cornell University are tax-exempt, the same municipal budget has to be raised from a smaller taxable base: the people living in Ithaca. This exponentially increases rates for homeowners and small landlords, making it almost impossible to live comfortably in Ithaca.Ithaca’s leadership needs to negotiate larger, extended agreements with Cornell and IC to ensure affordable living conditions for the people of Ithaca. They must expand the affordable housing supply through development incentives to save the people of Ithaca’s wallets.