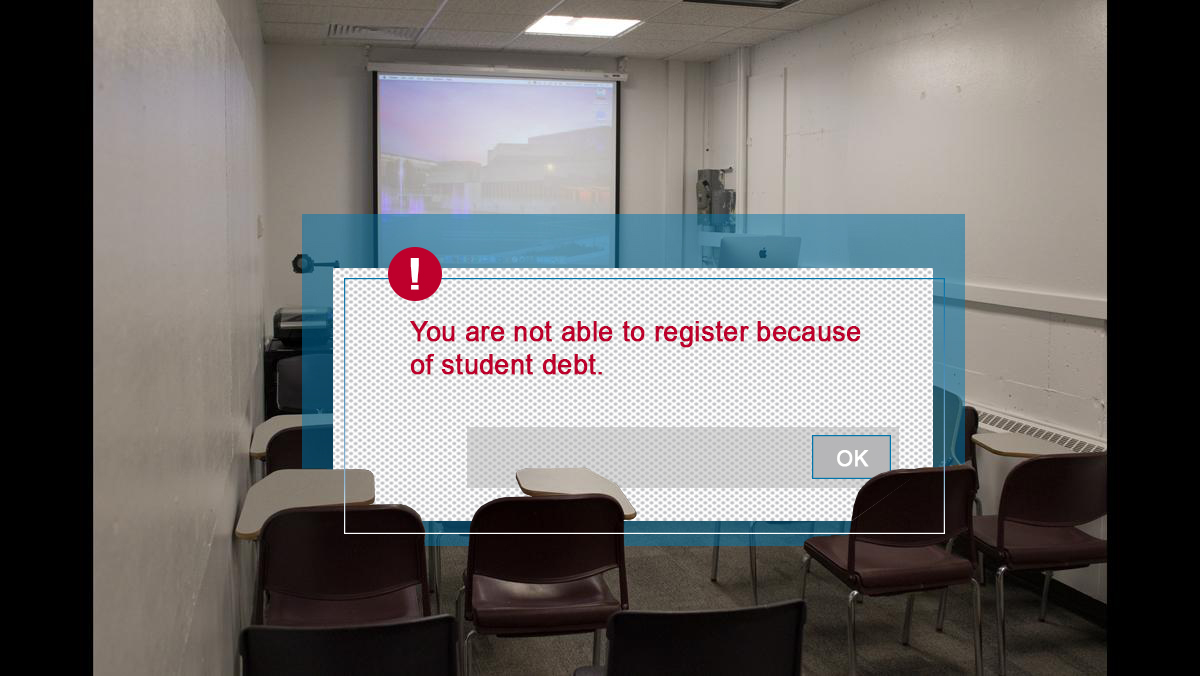

In a meeting with the Ithaca College Student Governance Council on March 25, Shana Gore, associate vice president of enrollment operations, management and student success, announced that the college will be unregistering students with outstanding debts between $7,000–$10,000 starting Aug. 15.

In the meeting with the SGC, Gore said the change from Quikpay, Nelnet and the 1098-T to Transact will primarily affect students who are not on a payment plan and have not communicated with the Student Financial Services about their financial situation and if they will pay off their debts.

Gore said to The Ithacan via email that she wanted to clarify that the new system is being implemented to help students navigate the financial aid process and, while the system is being changed, the deadlines are still the same as the previous semesters.

“The new system is being implemented to be more transparent and user-friendly for students, as well as offer more payment options,” Gore said. “For several years, IC bills have been due prior to the start of the semester; usually Aug. 10 for fall bills, and Jan. 10 for spring bills. We are continuing with those deadlines and removing registration for non-payment is adhering to that deadline for all students.”

Gore suggested that students who deal with financial hardship and know they will not be able to pay their bill by the due date should reach out to SFS and communicate that with the office. She also said students who pay off their bill after being unregistered will reregister for their classes based on the availability of classes left.

The Ithacan posted on Instagram March 28 about the change that will be implemented into the billing system. The post was met with strong reactions from former alumni, current students and parents disagreeing with the decision.

One comment made by Olivia Carpenter ’22, founder of Via’s Cookies, said she believed that disadvantaged students would be unfairly impacted by this change in the system. Carpenter said to The Ithacan that if the college implemented the change in the billing system when she was here, she would be unregistered for her classes because she was an economically disadvantaged student.

“As a former student, if I had faced those repercussions from not being able to pay for [my classes] on time, then I would have been dropped from [my] classes because I was a disadvantaged student,” Carpenter said. “I would come up with the money somehow, but sometimes it just took a little time.”

Some of the negative reactions the campus community have had about the new billing system stem from issues students have had with SFS at the college.

Sean Coppola ’23 said he thought the change would only make attending the college harder for students.

“It’s hard enough to get classes [that students are required to take],” Coppola said. “[This seems like it will] disproportionately affect students who already struggle with school.”

Coppola said that he had many issues with SFS, leading to him needing to work multiple jobs just to afford tuition, and that his financial aid was not consistent.

“I always needed more than I was getting,” Coppola said. “Whenever I would earn more financial aid, they would just say that my needs were already being met and take it out of other financial aid. … If my needs were being met then I would not be taking on a [residential] 10-hour-plus position and then also take on paid work.”

First-year student LaRon Pigford is a first-generation student and the first-gen senator for SGC. He mentioned a study The New York Times did in 2017. The study compiled a list of private colleges and universities and the average household income of students who attend the college.

The study showed that the average household income of a student enrolled at the college was $123,300, however, the household income of first-gen students and students of color in 2020 was $41,000.

Pigford said the decision to unenroll students who have debts is a decision that will make college inaccessible for students who are experiencing financial hardship.

“For someone who would not have enough financial aid, it can be extremely dangerous for that student,” Pigford said. “The reason being that they can’t afford it. They will not be able to afford a higher education. … We live in a world where there are certain ways for this college to be more affordable.”

Shadayvia Wallace, program director of the MLK Scholars and First-Gen Center, said that with the college introducing this new system, she believes that first-gen students will need more financial assistance.

“I’m going to be anticipating more first-gen students reaching out for support,” Wallace said. “Oftentimes, first-generation students have to navigate economically through scholarships, grants, working multiple jobs, both on campus and off. … I think it’s going to impact their ability to navigate payment plans or be able to even establish a plan if they find themselves in a situation where their debt outweighs their income.”

While the new system does not change the deadlines for bill submission or how much financial aid is offered, some students and alumni believe that unregistering students who have not paid off their bills will have an impact on student enrollment.

Carpenter said that if she was unregistered from her classes, it would cause her distress and would eventually question her enrollment with the college.

“If I were in that position [and] my classes [were] dropped, I would have started panicking,” Carpenter said. “I would have gone and asked all the people I could for things, taking a toll on myself, and then asking myself why am I at this college?”

Pigford said that with the introduction of this system, students are under the impression that they are not important to the college.

“People think that the college does not care about them at all,” Carpenter said. “They should have surveyed students first. I respect the work that they do, but I think it would have been beneficial for them to have student feedback” Pigford said.

Gore wanted to emphasize that communication with families and students would be constant and that students would know that they are being unregistered before it happens.

“If students have a family member or supporter who helps with paying the bill, they should add them as an authorized payer so that the supporter receives all important billing communications,” Gore said “Students are always encouraged to contact SFS to discuss their individual circumstances and learn about various options available.”

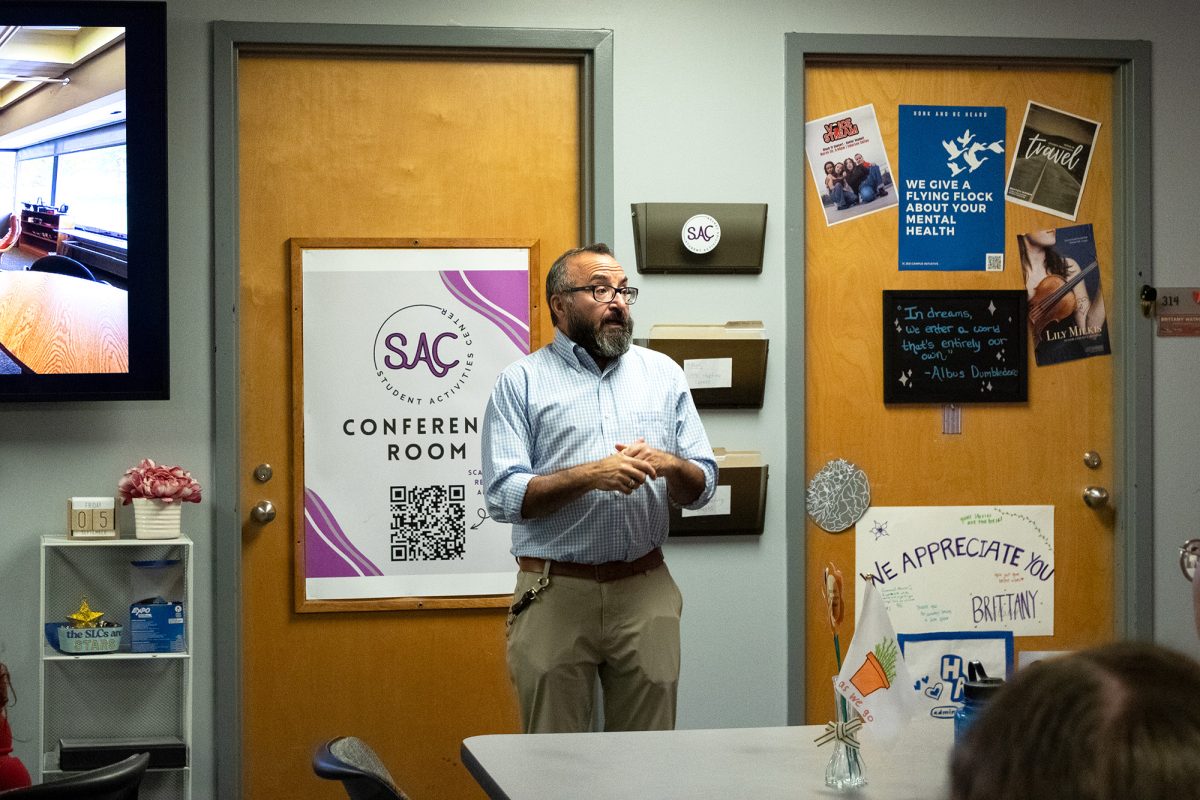

To help more students become aware of the change and ask more questions that they might have, Wallace thought that a good way to raise awareness was by having a listening session.

“I think having [an] info session so students are aware [would help],” Wallace said. “Everybody may not have social media [or] pay attention to their email, [and] more in-person opportunities to communicate with [SFS].”