Core Trading Consultants is a student-run finance organization at Ithaca College that holds a portfolio worth approximately $126,000 in assets, which is more than double what its portfolio was valued at four years ago.

Since 2020, CTC has seen a growth in membership and overall engagement. Membership is not restricted to students within the School of Business and provides experiential learning for professional and personal interests.

According to a survey conducted by CTC’s executive board and based on 54 responses, 46% of CTC members are outside of the finance major and 11% of members are outside of the School of Business entirely, including journalism, computer science, exercise science, biology and English.

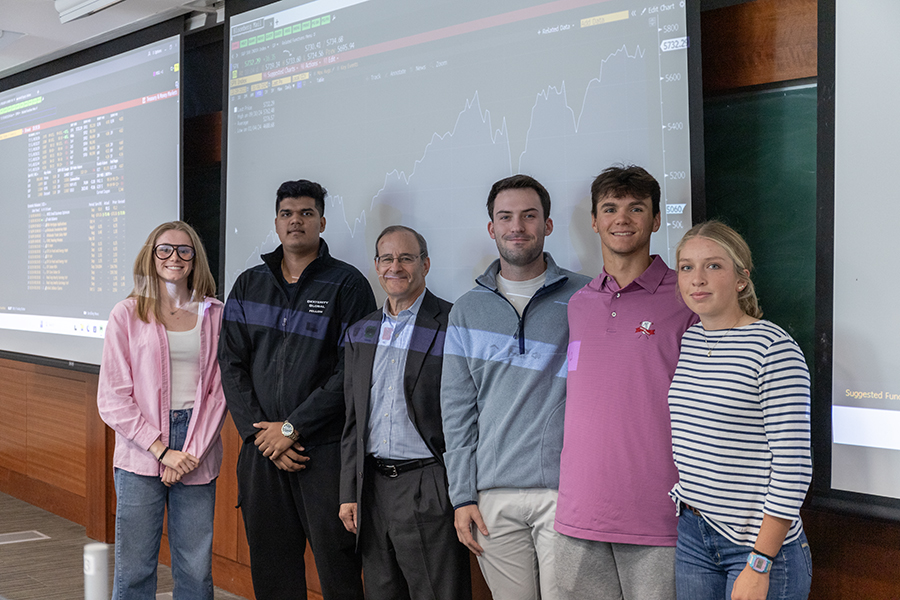

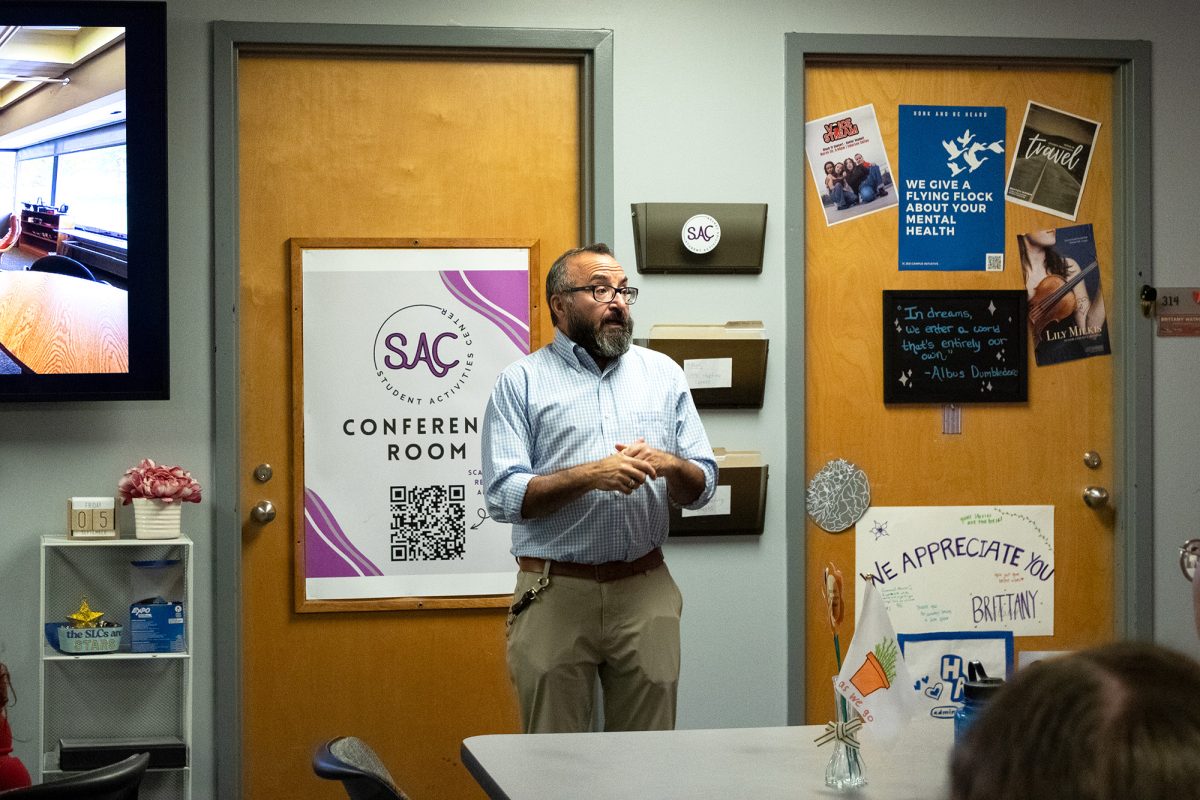

Matt Fox ’13, investment program manager in the Department of Finance and International Business, helps manage the trading room and said any students who have a general interest in the stock market can join. Fox said the mix of students from different programs is an important and beneficial aspect of CTC.

“A good chunk of students are interested [in] investing [in the] stock market,” Fox said. “Some students probably have their own investment accounts where they put some work money in once in a while and invest.”

In March 2022, CTC had 30 members. In 2024, CTC’s student base stands at over 60 active members. Junior Elle Wilcox, co-vice president of community and engagement for CTC, said the increase in members has positively impacted the camaraderie of the club.

“To see the trading room so filled is super special,” Wilcox said. “You can walk by those glass windows in the trading room, peek in, and you can see how busy it is.”

Senior Collin Feeney, chief operating officer for CTC, said CTC’s membership consists of junior analysts who deliver pitches and senior analysts who make the final investment decisions based on these pitches. Alumni and faculty listen in and provide insight on pitches, but do not have a say in the final decision. All profits made by CTC stay within the club and are reinvested.

Feeney said the pitches are led by the e-board and faculty, who assist junior analysts throughout this process.

“The entire process of giving the pitch and doing financial models is guided by [the e-board] and faculty as well,” Feeney said. “[That] is really helpful, especially when it’s your first time doing it. [It can be] extremely nerve-wracking because you’re going to the general body, giving a pitch, and it’s basically being voted as a buy or not a buy. You’re trying to convince [and] sell your company, and hopefully it’s successful.”

CTC’s portfolio is one of the three student-managed portfolios that make up the South Hill Fund — an overarching fund worth about $1.2 million that also includes the equity management portfolio and the fixed income portfolio. The South Hill Fund is overseen by the Investment Advisory Board. The IAB is made up of approximately 20 alumni and five faculty members.

Marc Weinberg ’80, lecturer in the Department of Finance and International Business, is the chair of the IAB’s and CTC’s adviser. He said that although the IAB supervises CTC, members of the club and the student-run e-board handle the majority of the decision-making process.

“We, as an investment advisory board, are not voting,” Weinberg said. “We can provide advice and guidance, point them in one direction or another if they ask for advice. But at the end of the day, it’s the CTC that’s actually voting on the pitches. The executive board and other senior members have a voice in whether or not the pitch for buying or selling a particular stock is going to be accepted.”

Along with making sure investments are profitable, CTC also follows moral guidelines. Wilcox said even if a stock has strong indications of being a successful investment, it will not be purchased if it does not align with CTC’s moral standards — like Philip Morris, the world’s leading tobacco manufacturer.

“[CTC chooses] to invest in ethical companies,” Wilcox said. “We don’t … invest in companies that don’t support making the world better. For example, people wanted to invest in Philip Morris. It’s a growing stock but unfortunately, that didn’t support and align with the club’s values of an ethical stock.”

The Global Asset Management Education Forum is the largest student-run financial conference in the world, hosted by Quinnipiac University. In March, 16 CTC members attended the GAME Forum in New York City. CTC placed third in the Undergraduate Small Fund Portfolio competition, earning a cash prize and marking its first-ever placement in a GAME forum competition.

Senior Sanskar Mehta, chief investment officer at CTC, said this was the first time CTC attended the conference since COVID-19 and said placing third out of over 150 schools signified CTC’s growth.

“Pre-COVID, we used to go there every year, but we started again and went there last year,” Mehta said.

Fox said that having students from across different schools is beneficial to CTC because it allows for a well-rounded range of perspectives.

“It’s really cool that we’re able to have students from the music school or the Park School [or] the humanities school also get involved and manage some real money,” Fox said. “It’s really important because they bring outside perspectives that can help shape the portfolio and make an impact in a big way.”

Dan Jones • Oct 9, 2024 at 9:12 pm

Very cool story. I bet the experience the students get is priceless!