By Kaeleigh Banda, News Editor • June 30, 2025

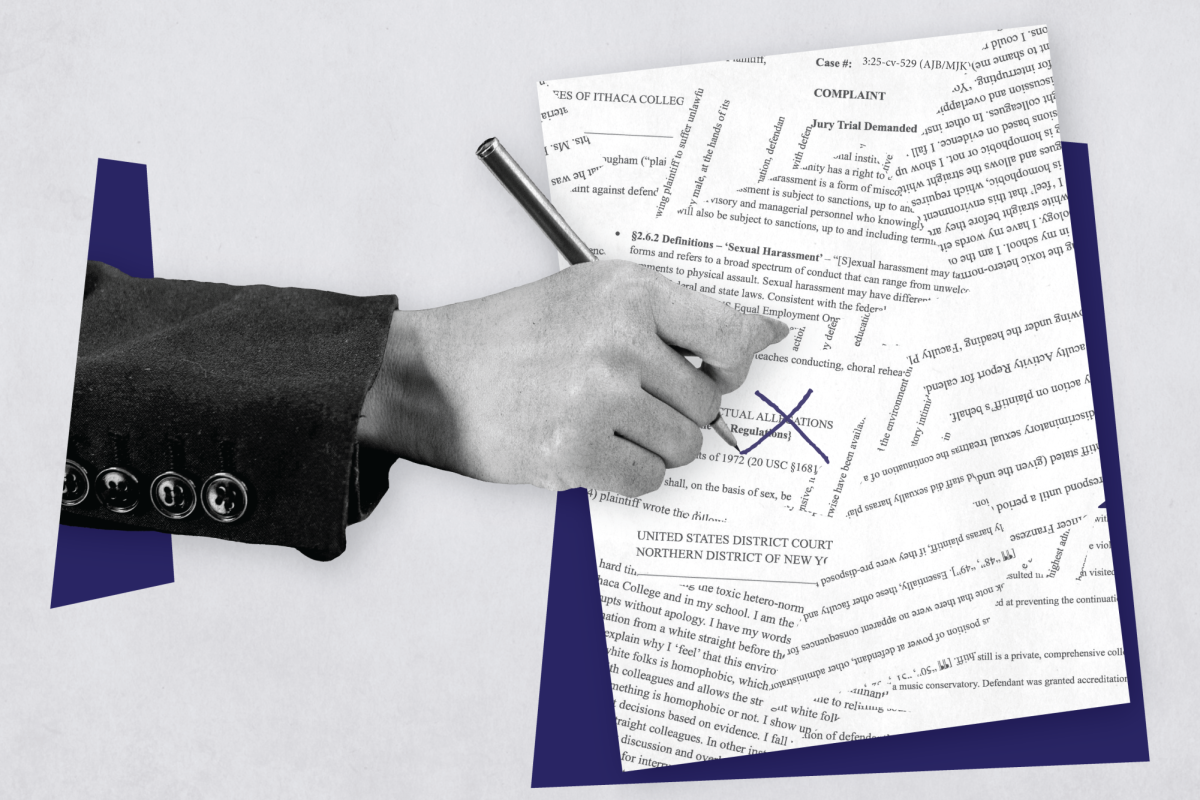

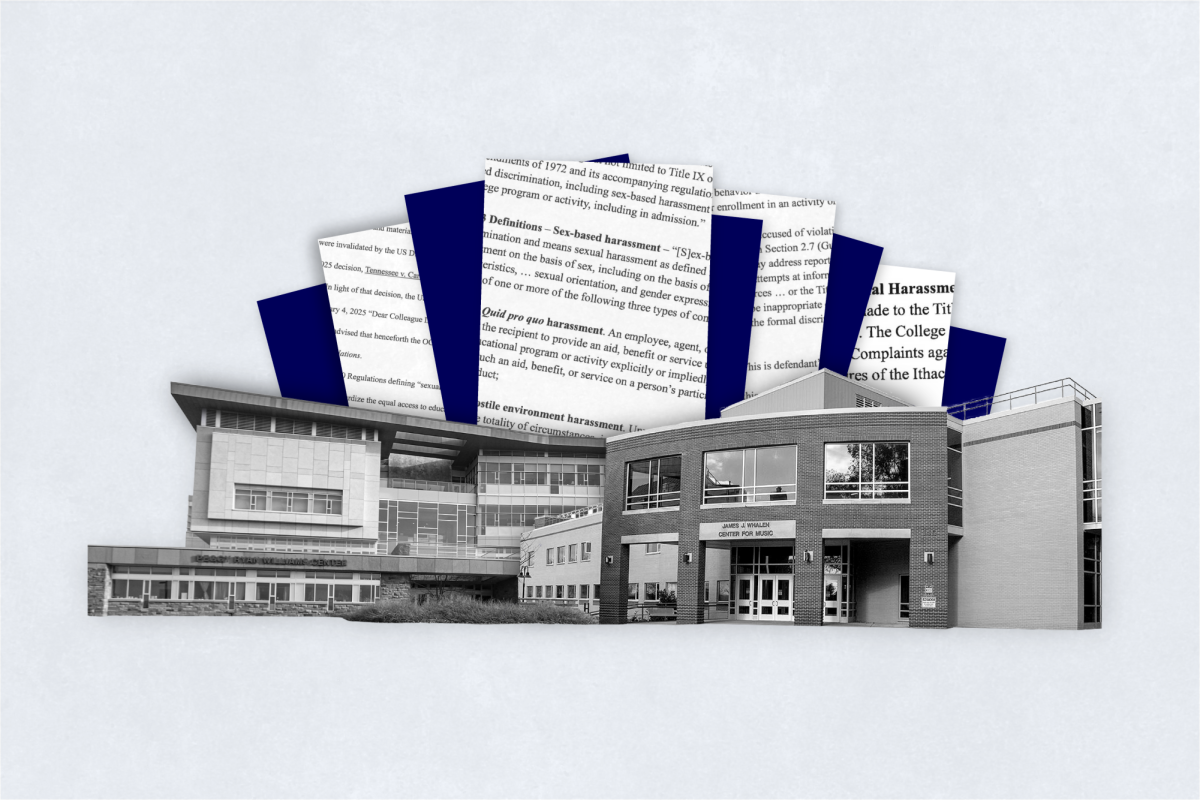

Ithaca College filed a motion to dismiss the civil lawsuit filed by Brad Hougham, a professor in the Department of Music Performance.

By Kaeleigh Banda, News Editor

The Ithaca College Division of Finance and Administration hosted a Dollars and Sense presentation May 29. The session was open to faculty, staff and students to discuss the college's performance in fiscal year 2025 and the FY 2026 budget. To continue to combat the college’s financial deficit, the discount rate for first-year students will be dropped from 64% to 60% by FY 2028.

By Isabella McSweeney, Sports Editor

Ithaca College announced that Aaron Bouyea has been hired as the next director of Intercollegiate Athletics and Campus Recreation. The announcement was made by Stanley Bazile, vice president for Student Affairs and Campus Life, on May 27. The college began searching for a new director when Susan Bassett ’79 announced in February that she planned to retire at the end of the 2024-25 academic year. Bassett had been director of the program since 2013.

By Eamon Corbo, Assistant News Editor

Ithaca College administrators shared updates on enrollment and the college’s finances going into the 2025-26 academic year at the State of the College meeting May 20.

By Kai Lincke, Community Outreach Manager

The students concluded their undergraduate studies with a fist bump from President La Jerne Cornish and remarks from two of the college’s most famous alumni, Bob Iger ’73 and David Muir ’95.

Brad Hougham, a professor in the Department of Music Performance, filed a civil lawsuit against Ithaca College on April 30. Hougham, through his attorneys, claims that he experienced a “hostile sexual environment” and anti-LGBTQ+ work environment on campus.

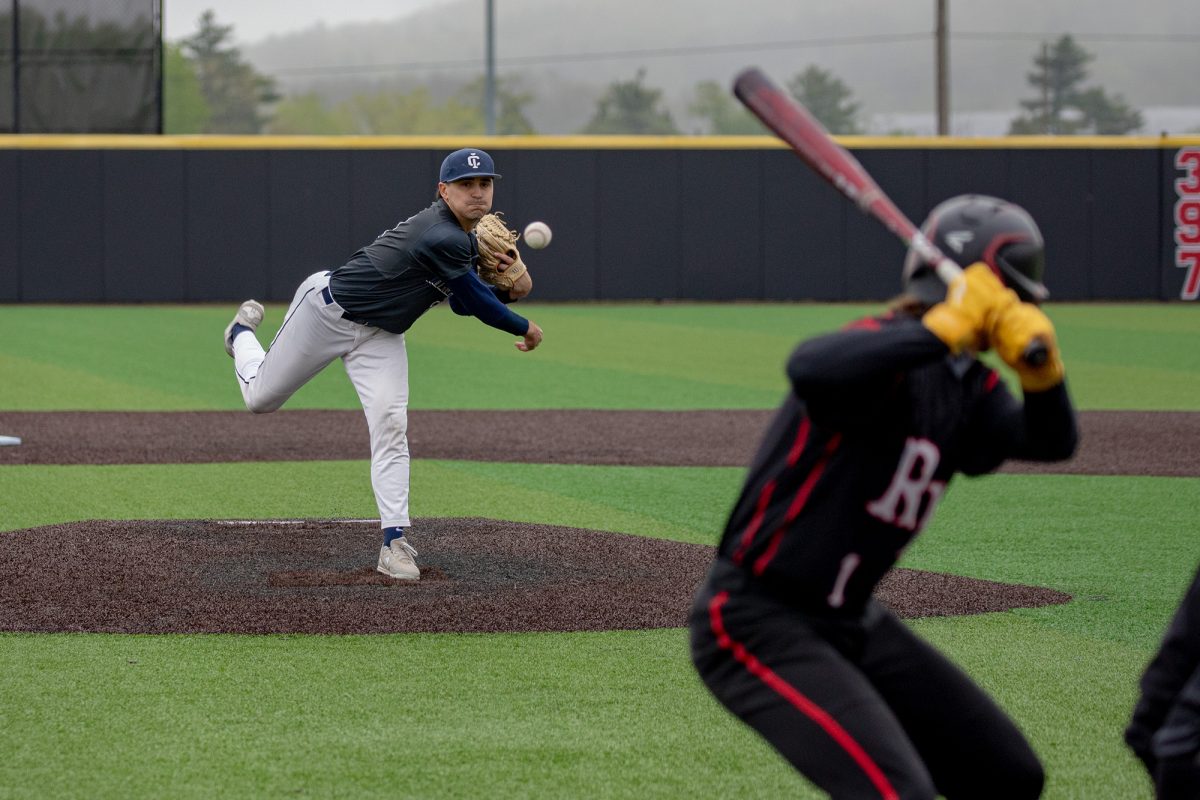

By Isabella McSweeney, Co-Sports Editor • May 13, 2025

The Ithaca College baseball team ended the 2025 season with a heartbreaking loss to the Rensselaer Polytechnic Institute Engineers on May 11 at Booth Field. After a 16-6 loss May 10, the Bombers fought to protect their Liberty League Championship Tournament title, but they were unable to find their groove

By Sheelagh Doe, Life and Culture Editor • May 15, 2025

Artificial intelligence is rapidly weaving its way into campus life, and our community is learning to navigate it in real time.

In a multi-week research project, our Advanced

In a multi-week research project, our Advanced

Advertise with us

Support Us

$3275

$3500

Contributed

Our Goal

Your donation will support The Ithacan's student journalists in their effort to keep the Ithaca College and wider Ithaca community informed. Your contribution will allow us to purchase equipment and cover our annual website hosting costs.

Donate to The Ithacan

$3275

$3500

Contributed

Our Goal

Submitting donation...

Thank you for your donation!

There was an issue submitting your request.