The 2024–25 Free Application for Federal Student Aid will be released on an unspecified date in December 2023 with several updates outlined in the FAFSA Simplification Act and implemented by the U.S. Department of Education.

The FAFSA Simplification Act, which was passed in 2021, outlined several changes to the form and processes that the government uses to determine federal student aid. The changes include restructuring the methodology used to calculate aid and expanding eligibility for the Pell Grant, which are intended to remove barriers and increase access to financial aid.

The FAFSA form has been available each year Oct. 1 since 2016, but because of the simplification, the 2024–25 FAFSA form will now be released in December 2023.

Students complete the FAFSA form each year to apply for federal student aid — including Federal Supplemental Educational Opportunity Grants, direct subsidized loans, federal work-study and the federal Pell Grant — to pay for the cost of college for that year.

Several states and colleges use the information recorded on the FAFSA to decide whether students qualify for financial aid and how much aid they should receive.

Timeline

Karen McCarthy, vice president of public policy and federal relations at the National Association of Student Financial Aid Administrators, said the unclear timeline for the FAFSA release is challenging for both students and institutions.

“Schools [need to] make their plans to make sure that they can adjust their calendars and get all of the work that they need to get done for their students done on time,” McCarthy said. “Especially incoming students who are trying to decide where they want to enroll, they need to have financial aid offers in hand.”

Shana Gore, interim associate vice president of Enrollment and Student Success at Ithaca College, said that if the form is released after the college’s winter break starts Dec. 16, it will be more difficult to guide students through the changes.

“We do plan to have people answering, monitoring email and things [during break,] but I won’t have the level of staff that we normally have,” Gore said. “l think particularly this first year … we need to have more appointments available for students and families that are having questions.”

Gore said the change in timing will have the greatest impact on prospective students because they will receive their financial aid packages from different schools later than they have in past years and will have a shorter window to decide which schools are most financially viable.

Gore said all students who applied early decision and some students who applied early action in previous years received their financial aid packages from the college in December or January. Gore said the college will provide an estimated financial aid package for students accepted for Fall 2024, but the college cannot provide a four-year financial forecast as it did for incoming students in Fall 2022 and 2023 until it has the FAFSA information.

Student Aid Index

In previous years, the information that students record on the FAFSA form has been used to calculate the Expected Family Contribution. The EFC is a number that determines students’ eligibility for financial aid based on students and their parents’ income and assets, family size and the number of family members in college.

Colleges must start using a Student Aid Index for the 2024–25 aid year instead of the EFC. The SAI is a number that is used to determine whether students will receive federal aid and how much aid they will receive based on students’ and their parents’ income and assets.

The SAI need analysis formula was revised from the EFC formula. In the EFC formula, students’ contributions from their available income was added to their assets contribution, which was then divided by the number of students in college. Gore said this formula reduced the EFC for students with siblings who were attending college at the same time.

The SAI will not consider families’ number of students in college at one time, which could cause a significant increase in some students’ payments.

All small business and farm owners who have an Adjusted Gross Income of at least $60,000 must now report these as assets to be factored into their SAI. Previously, only people who owned small businesses or farms with more than 100 employees had to report these holdings as assets on the FAFSA form.

Gore said she is concerned that this change will impact several students because the college has a large population of students from upstate New York, some of whom have family farms.

“Some of those farms have pretty significant assets when you think about the land and the buildings that they have, but the families are not actually having that liquid income to be able to spend on college or anything else,” Gore said. “Because this family farm [and] small business information was not captured on previous FAFSAs, I don’t have a way to anticipate how many of our students are going to be impacted.”

Pell Grant Changes

The Pell Grant is federal grant aid, which typically does not have to be repaid, for students who demonstrate significant financial need. Pell Grant eligibility and award amount is determined by the cost of attendance, full-time or part-time student status and the EFC prior to the 2024–25 aid year — now the SAI.

The FAFSA Simplification Act states that Pell Grant eligibility will be calculated based on the student’s family size and their families’ Adjusted Gross Income compared to the federal poverty levels.

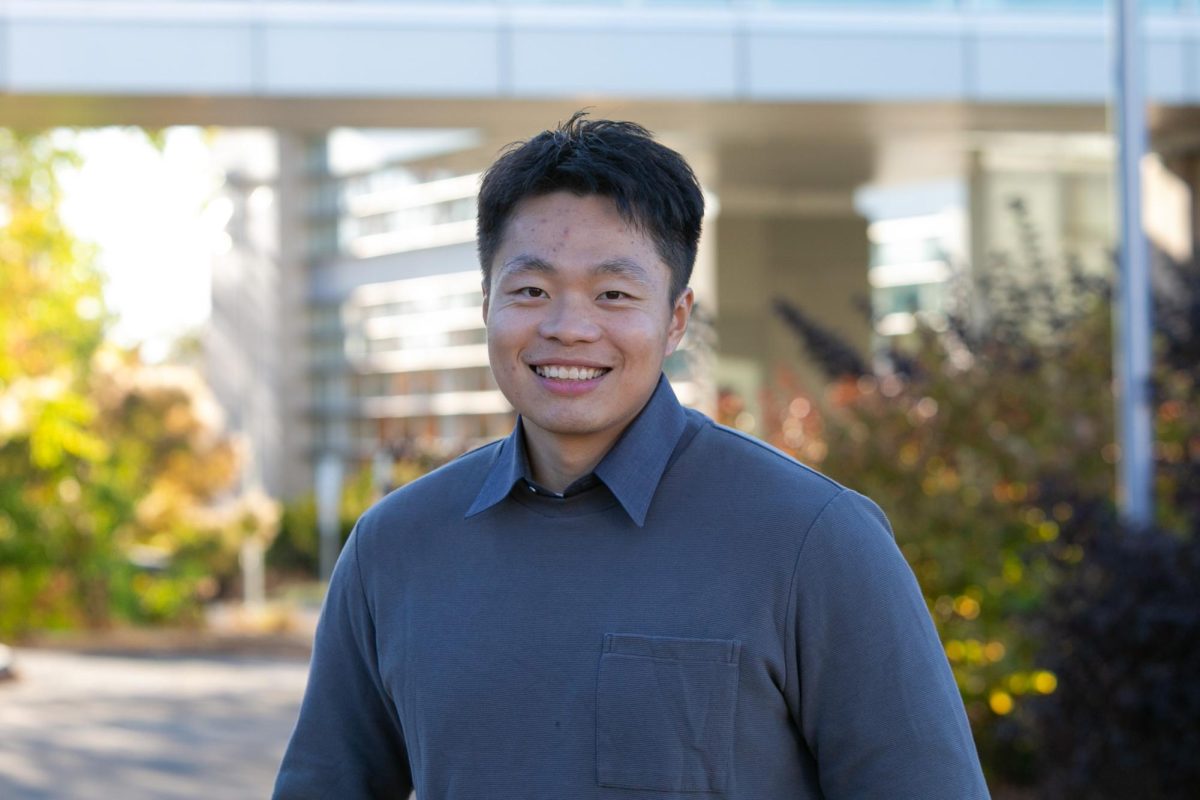

Junior Nathan Zakim said that he receives subsidized and unsubsidized federal loans and that he has taken out additional loans to pay his college bill. Zakim said he has four jobs on campus to earn money to repay the loans.

Zakim said he is glad that the federal government has expanded eligibility requirements for the Pell Grant. However, he feels the federal government should further reconsider the formula and structure of calculating students’ financial aid because it does not fully account for students’ and their families’ ability to pay for college.

“My parents have bills and they have car payments and mortgages and insurance payments that are all just as, if not more necessary, than my collegiate education, which in the end was my decision to go to,” Zakim said. “So then the money problems fall on the student. … Even if it’s a standard and it’s mathematical government procedure, it doesn’t account for individual experiences.”

Accessibility

Sophomore Kendra Atstupenas is a first-generation college student who receives subsidized loans and a Pell Grant. Atstupenas said she submitted the FAFSA late before her first year at the college because the requirements were unclear.

“This whole process was new to me,” Atstupenas said. “My parents didn’t fill out FAFSA so … filling out the FAFSA was a huge stressful thing because I didn’t know how to do it.”

Atstupenas said she just started to understand the process to complete the form after doing her own research and is concerned that the format and requirements are changing again. She said she hopes that the Department of Education will provide clear guidance about the changes.

The Brookings Institute reported that the FAFSA’s complexity and students’ lack of understanding of the cost of college and their options for financial aid have acted as barriers to applying for or attending college.

Federal Student Aid’s 2024–25 FAFSA Roadmap states that the FAFSA simplification process should make the process easier overall, as some questions will be cut and simplified.

McCarthy said the FAFSA has not necessarily reduced the number of questions for all applicants, but some applicants may see a shorter FAFSA if they consent to connect their financial information listed on their IRS tax returns to the FAFSA.

Gore said the college is trying to provide as much information as possible for prospective and continuing students as they wait for the FAFSA information and will post all updates about the process to the 2024–25 FAFSA Simplification website page.

“This is a year where things are kind of developing and changing as we move,” Gore said. “I think that also we’re going to see unique situations that maybe we didn’t know were going to happen as students move through this process. And so anytime that they have questions or concerns when it comes to the financial aid piece … [they should] reach out and have a conversation, share their concerns.”