Simultaneously invoking shock at the excesses of Wall Street and shedding light on the 2008 financial crisis, one of the least understood crises in U.S. history, “The Big Short” prompts a re–evaluation of American capitalism and an insight into the cutthroat nature of the financial sector.

Based on Michael Lewis’ bestselling book “The Big Short: Inside the Doomsday Machine,” director Adam McKay, famous for his work in “Step Brothers” and “Anchorman,” diverges from his previous work to produce a film that, while comedic at times, engages in a deeper purpose of exploring the nature of unfettered greed and the fragility of the financial system.

With a star-studded cast, “The Big Short” features a plethora of ethically ambiguous, yet engaging, characters, including Michael Burry (Christian Bale), an eccentric, socially inept number-cruncher who blasts heavy metal in his office while pouring over mortgage bonds. It is Michael who first projects the collapse of the financial system by examining mortgage bonds and realizing that although the bonds are supposedly stable, many of the bonds are actually subprime, or in the words of the film, “filled with shit.” As a result, he puts his investors’ money into credit default swaps, shorting the housing market and betting that it will fail.

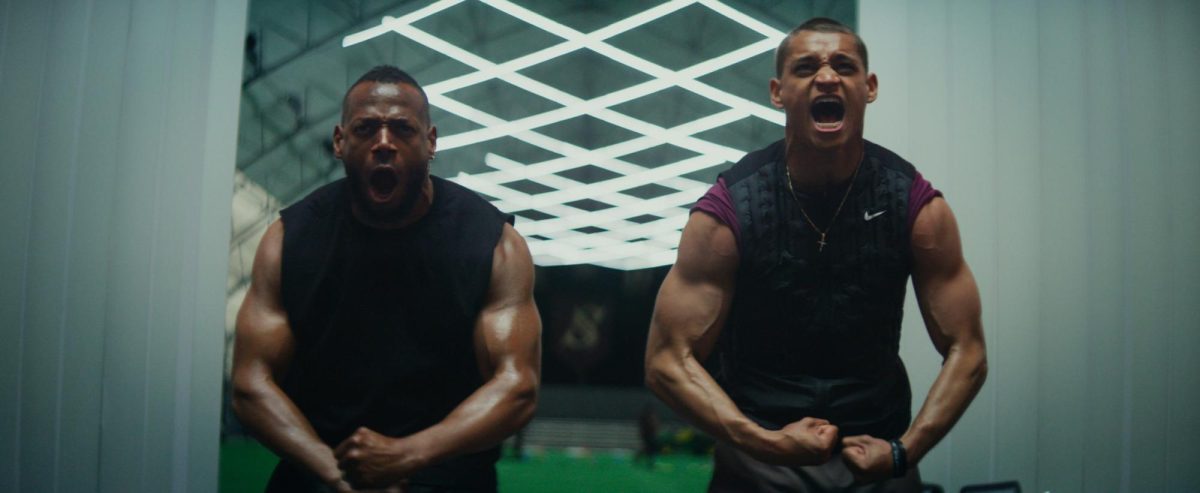

Burry’s gambit grabs the attention of Jared Vennett (Ryan Gosling), an aggressive, cocky trader who also serves as the film’s narrator. Jared partners with Mark Baum (Steve Carell) to short the market. Additionally, Charlie Geller (John Magaro) and Jamie Shipley (Finn Wittrock), two young and ambitious investors, sniff out the money-making opportunity and, with the help of former banker Ben Rickert (Brad Pitt), finagle their way into the scheme to short the housing market.

Despite the heavy subject matter, McKay manages to make the film funny, offsetting some of the distress caused by watching characters knowingly bet that the entire economy will collapse. Carell and Bale, in particular, have a multitude of comedic moments, which McKay places strategically to prevent the film from getting bogged down.

McKay also excels at boiling down complex financial jargon into understandable concepts and explanations. Although simplistic, this mechanism keeps the viewer from losing interest in a film that doesn’t seem like an inherently exciting experience at first glance. After all, who goes into a movie wanting to learn about the housing market? However, McKay is able to make the subject matter engaging by approaching it not as an educational immersion into the world of banking, but more as a fast-paced, thrilling heist with fluidity and morally questionable characters.

Perhaps the most devastatingly impactful element of “The Big Short” is McKay’s impeccable character development and portrayal of the arrogance and carelessness of the big banks the main characters are betting against. This makes it impossible not to root for these characters as they hope for the housing market to collapse and an economic crisis to ensue. But with the exceptions of Carell and Pitt’s characters, no one in the film expresses any moral qualms about making money off a financial collapse that costs multitudes of innocent people their jobs, their homes and their livelihood, making the desire to see those characters succeed even more perverse.

The truly horrifyingly powerful part of “The Big Short” is it shows how easy it is to become siloed in the mindset of profit above all else, even if it comes at the expense of others. Despite being outraged at the amorality of the characters, it is possible to see oneself and the desire to increase one’s own individual standing reflected in the actions of the characters.

Throughout the film, Carell and Bale are standouts, as their characters have the most interesting back stories and engaging personas that allow the viewer to relate to them despite their obvious personal flaws. Both actors take advantage of the fullness of their characters and exude the persona of their characters during the film, making it hard to reimagine Carell in “The Office” or Bale as Batman. Pitt delivered a solid performance as well, although it often felt like he didn’t have as much to work with as the other actors did. Pitt’s character sometimes seemed like a mechanism to move the plot forward rather than a full-fledged character.

“The Big Short” succeeds in provoking a deep sense of outrage over the excesses of the financial system and conveys the degree to which banks played it fast and loose leading up to the crash. The film tells the important story of what really happened with the big banks and the housing crisis. With a sense of economic injustice permeating much of the country, the film hits a nerve and harnesses the emotion of a populace that is becoming more and more disenchanted with the power of Wall Street.