The Town of Ithaca is considering removing Ithaca College from its fire protection district, citing an unwillingness by the college to pay for fire protection services.

As a tax-exempt institution, the college does not pay for fire protection services for the main campus, Ithaca Town Supervisor Bill Goodman said. For the Circle Apartments, however, the college does have a PILOT agreement — Payment in Lieu of Taxes — for which the college provided $33,424 to the town during the fiscal year of 2016, according to a statement by President Tom Rochon.

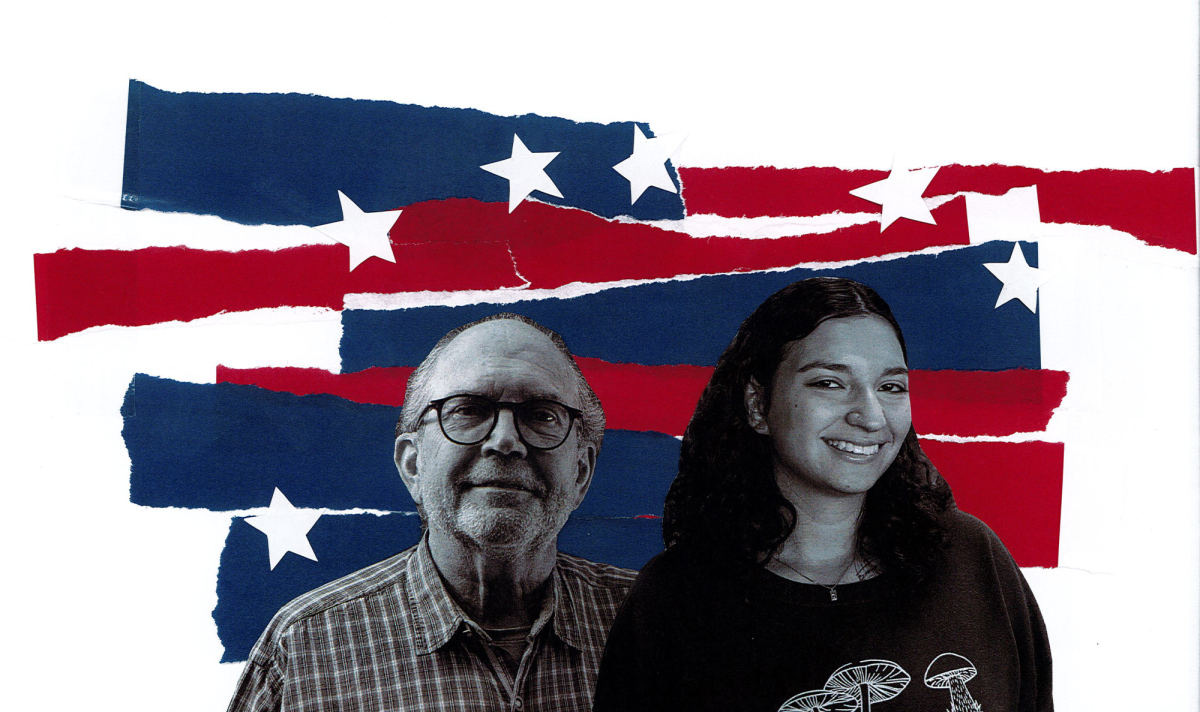

Goodman said the town is asking for a greater contribution because fire protection takes up a large portion of the town’s taxable income. Goodman said about 40 percent of the town’s property is tax exempt, and Ithaca College is “a huge portion of that,” with fire protections making up around 50 percent of what taxpayers pay on their property tax bill.

Goodman said the town has been in communication with the college about paying a contribution for fire protection services for at least two years.

However, Rochon wrote in a statement that the town cannot legally exclude the college from fire protection services and the college would fight any attempt in court.

“Any threat by the town to refuse to provide fire protection … would not only be an extraordinary departure from well-established state law, but also tragically misguided, and the college would vigorously challenge it in court,” Rochon said.

While no decision has been made yet, if the town chooses to move forward, the change would require a public hearing and referendum. Goodman said this will be discussed at the Town Board’s Oct. 17 meeting, which would be the earliest the town would make a decision.