Student debt in the United States grew to another all-time high in 2015, and Ithaca College students are not exempt from the issue.

Of the seniors who graduated in the 2015-16 academic year from both public and private colleges in the United States, 68 percent left with an average of $30,100 in student debt, according to The Institute for College Access and Success. The average amount of debt with which students at Ithaca College graduated was $30,000 for the last academic year, said Mark Kantrowitz, an expert on student financial aid.

Kantrowitz’s estimate comes from the College Scorecard, a site made by the Department of Education for students and parents to compare college financial data. The college estimates that the average total federal loan debt for the Class of 2012 was $23,849, but this doesn’t include private loans, which Kantrowitz accounts for.

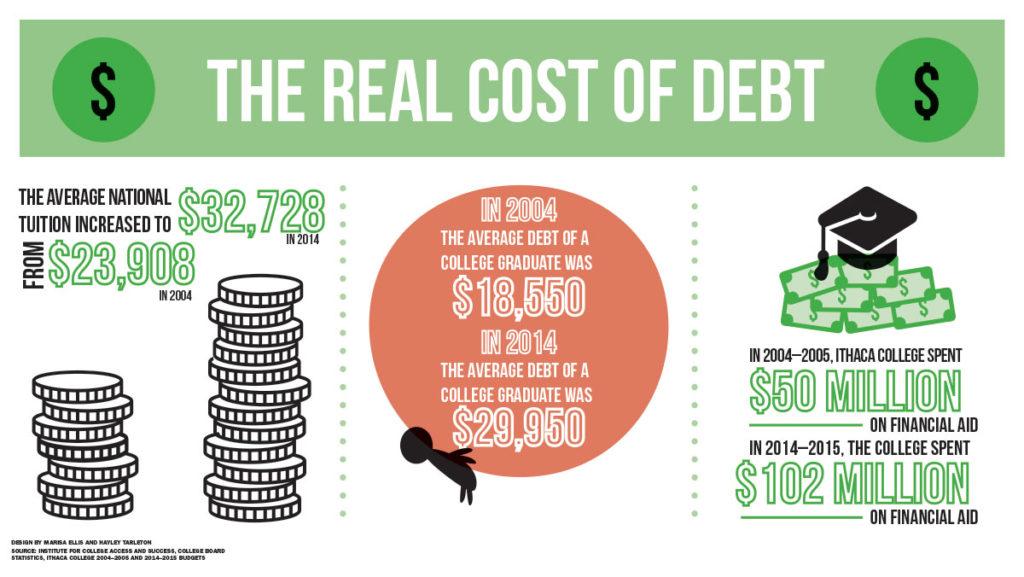

Tuition and fees at the college totaled $55,332 last year, according to the 2015–16 college budget. Tuition and fees in 1995–96 cost $22,079 and in 2005–06 totaled $35,144, according to the college’s budgets for those years. This increase represents a steady trend among colleges across the country that has seen tuition skyrocket over the past 20 years, Kantrowitz said. The average cost of tuition went from $12,975 in 1994 to $32,728 in 2014, according to the College Board and the National Center for Education Statistics.

Because of these increasing costs, the amount of aid that students must get in order to pay for college has also increased. In 1991, about 40 percent of first-year students received financial aid from the college, and in 2013, that number was at 90 percent, according to the 2014–15 budget. In 2004, the average debt of a college graduate was $18,550, and in 2014, that number was $28,950, according to the Institute for College Access and Success. In 2003, the average debt of all students in the U.S. was around $300 billion; that number is currently around $1.2 trillion.

Kantrowitz said these increases in tuition come from faculty and staff pay increases, rising energy and equipment costs, and state appropriation funding changes.

And student debt has been rising, Kantrowitz said, because the government has not been giving enough financial support to students.

“Student loan debt at graduation increases because of a failure of government grants to keep pace with increases in college cost on a per-student basis,” Kantrowitz said.

He said student debt is rising faster than the government is increasing its funding to counteract it. In the 1970s, the maximum Pell Grant that could be given to students was around $1,400, and this year, the maximum is $5,815. Over the same period, the average tuition and fees for all colleges went from $10,415 in the 1969–70 school year to $28,659 this year, according to the National Center for Education Statistics and College Board.

Freshman Ashley Stacey said she has received far more in scholarships from the college than money from the government. Stacey said she is projected to owe $7,000 by the end of her first year and has gotten over $30,000 from the school in the form of scholarships and only $2,500 in federal loans.

Junior Kelilyn Rogus said she currently owes around $60,000 in debt but gets more money from the government — around $10,000 in grants — than from the college — around $8,000.

Over the years, the college has been providing more and more financial aid to students. According to the 1991–92 budget, in that year, the college brought in about $69 million from tuition and fees and spent around $16.5 million on financial aid to students. From 2014–15, the college brought in $318 million through tuition and gave $102 million to students through financial aid. Spending on financial aid increased by 518 percent between the two periods, while tuition costs increased by 361 percent.

Lisa Hoskey, director of student financial services, said financial packages always vary per student.

“Every student situation is different,” Hoskey said. “Some students do not borrow at all. Some students only borrow the federal loans. Some students borrow more in private loans to cover cost.”

This is true for someone like sophomore Lauren Kleiman, who said she pays no money for college because she was given enough money in scholarships and federal grants, though more of that money comes from the college. She said she understands that while she is not affected by student debt, others are.

“It’s ridiculous that students have to pay so much in student debt,” Kleiman said “It’s definitely a national issue that we need to pay more attention to.”

Junior Virginia Maddock said she will owe around $150,000 by the time she graduates. She said she thinks the government should help students decrease their student debt through increasing funding for grants and scholarships.

“I would like college to be free, or at least less,” Maddock said. “I mean, there is definitely the resources to provide the same quality of education for significantly less money.”