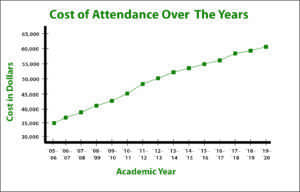

Ithaca College’s sticker price has seen a sharp uptick in the past decade. It currently sits at $61,132 for tuition, room and board for the 2019–20 academic year. Due to these rising costs, it is unclear if students can continue to bear the weight of generating the bulk of the college’s revenue.

“It’s an industry challenge,” said William Guerrero, vice president of the Division of Finance and Administration. “Certainly, cost of attendance is a concern of mine. And so what is happening is you have a lot of financial aid … to make that really affordable. But is it … really sustainable? I don’t believe it’s sustainable.”

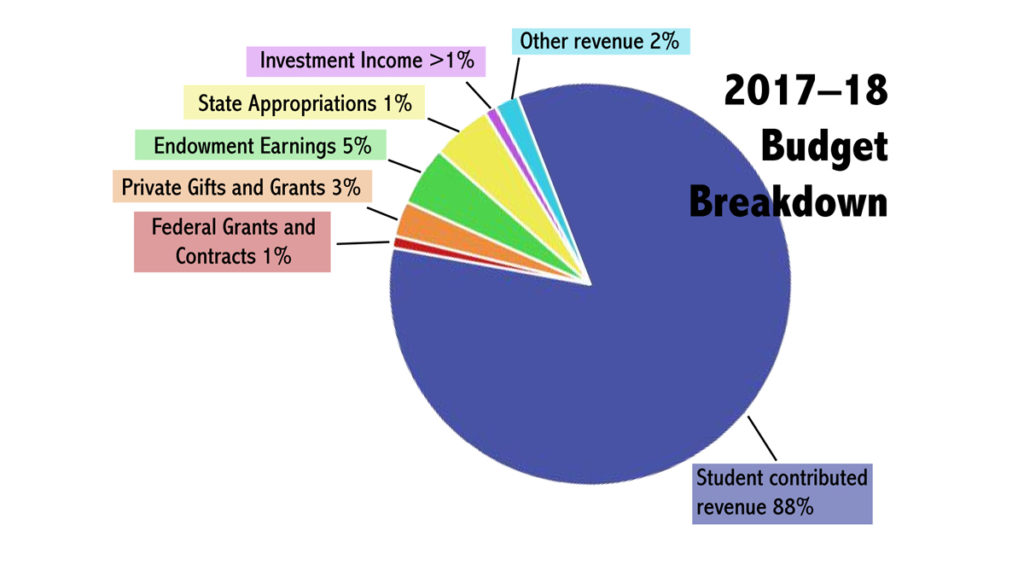

The college’s operating budget is primarily reliant on student fees. Guerrero said student fees, including tuition, room and board, account for 88 percent of the college’s budget, a percentage that has remained consistent over the years. As tuition continues to rise at the college and other higher education institutions nationwide, there are concerns that the price tag for the college will become unattainable for most students to meet. Although the college’s undergraduate enrollment has remained relatively consistent over the past few years, if the college’s main revenue source — students — is ever depleted, the college could face a financial crisis.

Salvador Aceves, senior vice president and chief financial officer of Regis University and a facilitator in the Planning Institute in the Society for College and University Planning, said a cut in enrollment could cause major financial disruption.

“A drop in enrollment would result in a quick margin drop, resulting in possible operating losses,” Aceves said via email. “This is not only difficult for any institution to resolve, but it also puts the institution on a challenging financial path. If it continues, it could compromise the institution’s future.”

Scott Carlson, senior writer at The Chronicle of Higher Education and author of “Sustaining the College Business Model: How to Shore Up Institutions Now and Reinvent Them for the Future,” had a more urgent tone when contemplating a drop in enrollment for a college heavily reliant on student fees.

“A sudden drop of hundreds of students one year would be … how do I put this? … Disastrous,” he said via email.

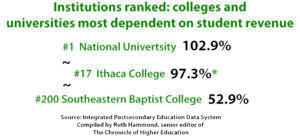

Guerrero said his personal target for the student contribution to the college’s revenue is in the mid-80 percent range. Ruth Hammond, senior editor of The Chronicle of Higher Education, compiled data from the Integrated Postsecondary Education Data System to compare the college’s tuition dependence to other nonprofit private colleges’ revenue models. When looking at cost of attendance and auxiliary expenses — which includes smaller fees, like ones for health service and athletics which are not included in Ithaca College’s cost of attendance computation — the college had the 17th highest dependency on student fees compared to other colleges in the 2015 Carnegie classification. However, 142 out of the 200 colleges in the classification relied on these fees for 85 percent or higher of their revenue. While the college is on the higher end of reliance, it is on par with similar institutions.

In order to lower the percentage of student contribution, the college would need to diversify its sources of revenue.

The income generated by the college’s endowment accounts for about 5 percent of the college’s revenue. Federal and state grants, which faculty and staff are encouraged to apply for, and the Annual Fund, which is unrestricted donations, each account for just 1 to 3 percent of the college’s revenue, Guerrero said.

President Shirley M. Collado said she agrees with Guerrero that the reliance on students for the majority of the college’s revenue is an issue. She said that through the work of the senior leadership team and through the strategic planning process, she hopes creative ideas can be formed to help solve this financial situation.

“A viable and innovative financial plan for Ithaca College’s future is something that needs everyone’s ownership and best thinking,” Collado said via email.

Carlson said the college must adapt given the changing conditions of who is enrolling in higher education institutions. According to the Western Interstate Commission on Higher Education, the number of high school students graduating in the Northeast is projected to decrease over the next 10 years. He said an issue that the college might face is a lower enrollment due to the Excelsior Scholarship, an aid package funded by New York state that provides aid to select families with an adjusted gross income of $125,000 or less to enroll at SUNY and CUNY institutions, which may encourage high school students in New York to enroll elsewhere.

“How long can these private colleges continue to operate in a really difficult environment, given that the demographics are going downhill and the cost of labor is still going up all the time?” Carlson said.

Aceves said it is important for higher education institutions to diversify revenue away from being student-centered because of the changing demographics in higher education. The National Student Clearinghouse Research Center found that there was a 1.3 percent decrease in enrollment in Spring 2018 compared to the previous spring. New York is the state with the largest enrollment decline. Aceves said that especially in the Northeast, there is a significant drop in the number of 18-year-olds graduating from high school and enrolling in college.

“If I were to look across higher education, there’s probably more capacity than there is available students … so that makes it really tough when you are so reliant on tuition,” Aceves said.

While Aceves did acknowledge that the sticker price for higher education institutions is generally increasing, he said the cost is worth it as long as the institution invests in the student learning experience, success and graduation rates. The college has made its fair share of these investments since Collado’s tenure began. In September 2018, the college divided the Office of Student Engagement and Multicultural Affairs into three units, including a newly created Center for Inclusion Diversity Equity And Social Change (IDEAS); the Office of New Student and Transition Programs; and the Office of Student Engagement — all with the hope of better supporting students. The college took $6.7 million from the budget surplus to be put toward salaries and benefits, including the new positions within the Division of Student Affairs and Campus Life.

Guerrero said that while he would like to lower tuition, the college’s entire business model would have to change in order to do so. Instead, he wants to focus on changing the costs of other areas, like meal plans or rooming, to alleviate some of the financial pressure from students.

Since he began his position at the college in July 2018, Guerrero has been attentive to the student body’s concerns. He has previously presented some of his ideas to increase affordability at the college and to improve the student experience to the Student Governance Council. His plan to reform the college’s dining hall experience is at the forefront. He said he wants to create a cheaper unlimited meal plan to address food insecurity at the college and to make the dining experience simpler and more affordable and accessible.

He anticipates that there will be one mandatory unlimited meal plan for resident students and one voluntary meal plan for students who live off campus or in on-campus apartments. Although the prices are not fully set yet, he said the idea is for the unlimited plan to cost less than the current 14 meals per week plan, which starts at $6,994 for the academic year. It is unlikely that the plan will cost less than the current 10 meals per week plan, which starts at $6,580 for the academic year.

“When I look at the dining, there’s so many different meal plans, it’s kind of confusing, and it’s all across the board,” Guerrero said. “So looking at all those prices and types of meal plans, having a flat price that solves meal insecurity, it’s interesting how the math works. It’s not easy, but you ultimately want to make it much easier for students to eat on their time.”

Guerrero said the college is in the process of finalizing the programmatic changes and prices and hopes to have the changes implemented for Fall 2019.

“That’s the beauty of having someone new, with different perspectives and different eyes of trying to go, ‘Well, this how we can make it student-friendly and student-appropriate,’” he said.

Addressing other student concerns may not be as cost-efficient to students as the reduced meal plan. Students have been frustrated about the crumbling infrastructure on campus, specifically in residence halls. Guerrero also said that further down the line, renovating campus housing, specifically the Terraces and the Quads, is on the college’s radar but that it is more difficult to carry out due to the question of whether these areas should be torn down and completely remodeled or smaller cosmetic renovations, like updating bathrooms and kitchens, should be undertaken. He estimated that the former plan could cost over $100 million, whereas the latter would be about half the price.

Guerrero said an issue with tackling on-campus housing is that there is no immediate solution for current students. Projects like these take time and commitment in addition to the large cost. If large renovations like these were to occur, the current students would indirectly be paying these costs; part of the bond that the college would take out to pay for these renovations would be paid by the students’ payment of the room rate.

Beyond the Terraces and the Quads, two other areas the college is looking to improve are the Hammond Health Center and the Campus Center. For the Health Center, he said it is important to not only think about the structural state of the building but also how to better it programmatically. While he could not provide details due to the plan being in early discussion stages, he said he wants to focus on if the Center of Counseling and Psychological Services can be better integrated to serve students in the existing space. Guerrero said it is difficult to prioritize which of these areas will be worked on first, but they are all on the college’s radar.

The college’s budget surplus dropped from $20 million to $5 million for the 2018–19 academic year due to the college’s increase in financial aid awards, new technology, increases in faculty and staff benefits, and deferred maintenance costs.

“When you think of areas that need attention, and there’s no doubt you can go anywhere on the campus and find it, that term is called deferred maintenance,” Guerrero said. “We’re much better situated than a lot of schools out there. When you look at how nice our campus is and looks, yeah, there’s those spots, like Quads and Terraces, but those are predominant areas of where deferred maintenance is.”

Guerrero said he views the surplus as an opportunity to provide support for students and would rather spend the money to provide more resources to students than to have a large surplus.

“I’m not a huge fan of having a huge surplus,” he said. “The way I look at it, if we have a huge surplus, as we have had historically, in my viewpoint, then I am not budgeting appropriately. Therefore, if I had a huge surplus, then why didn’t I charge a lower tuition or lower room and board?”

Senior Kathryn Kandra said that while renovations and improvements to food could be beneficial, she thinks it is also worthwhile for the college to prioritize other aspects of the student experience, like the quality of professors, classes and transportation on campus.

“I think a continued focus on student success, more alumni support, the Career Center, things like that, those are the things I think they should focus on if they are thinking about not only renovations, just student happiness at this school,” she said.

Freshman Minah Saint Cyr shared a similar sentiment. She said a higher cost of attendance would be justified if the money was being allocated toward updated facilities in academic buildings or more resources.

“The reason people go to college is to form new experiences and get an education,” Saint Cyr said. “People who graduate from college don’t look back and say, ‘Oh, the food and the housing was so great.’ Those aren’t the perks of going to college.”

In addition to strengthening the current student experience, the college is planning to diversify revenue sources. Guerrero said he anticipates the five-year strategic plan will encourage the college to look into new ways to diversify the revenue and decrease the financial burden on students.

Guerrero said that while plans are not definite, he sees potential in cultivating partnerships with members and organizations in the community to drive grants, to create new educational models or to share resources to save expenses. For instance, if the college was to conduct off-campus housing with a partner for faculty, staff and graduate students, that could be a new potential source of revenue.

He also said he views the summer as an opportunity to bolster the college’s resources. He said that with the freshman summer orientation moving to the end of August, the college has more time to utilize the campus for additional partnerships, such as creating different summer programs, like summer camps for high school students, or to hold more summer classes to help with student retention.

Metropolitan State University in Denver partnered with Sage Hospitalities to open a hotel on campus. This partnership provided students with career experience and boosted the college revenue by $2 million. The University of Houston offers a number of summer courses for kids and teens, which is an additional source of revenue.

The college’s endowment is not insignificant in contributing to the revenue. The endowment for the 2018–19 fiscal year is $316,025,347. Guerrero said he does not view the endowment as a safety net but rather as support for students and as financial aid. He said it is not structured as a rainy-day fund and has specific restrictions based on the

donors’ requests.

The college’s endowment has been on an upward trend; in 2017, the endowment topped $300 million for the first time.

“We would like it to be much higher for the grander [sic] goals to make it less student–dependent,” Guerrero said.

Guerrero said he is excited to move forward and come up with different ways of diversifying the budget to help students.

“Without any definitive ideas or decisions saying this is how we are doing it, that’s the reason why we’re having a strategic plan, is, how do we do things differently?” Guerrero said. “Not to say that things were done wrong, it’s just the landscape has changed. School is expensive; we don’t want it all to be on students. So how do we diversify it?”